We catch up with WA's Broker of the Year 2022 to find out why he set up his own brokerage, how he's helping clients navigate the current building construction crisis, and what he enjoys most about the industry.

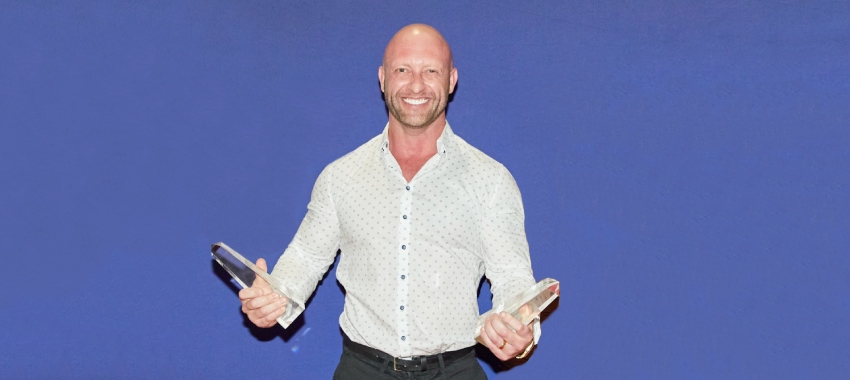

Managing director of Core Finance, Adam Burstein, was recently crowned WA's Best Residential Broker and Broker of the Year at the Better Business Awards 2022.

The Perth-based broker spoke with host Annie Kane on the Elite Broker podcast to talk about his journey through many different occupations before he entered the world of broking, what he enjoys most about the industry and some of the challenges facing clients who want to build their own homes due to the turbulence in the construction industry (find out more in the August 2022 edition of The Adviser magazine, out next month!).

This content is available exclusively to

The Adviser premium members.

How long have you been a broker?

I’m currently in my sixth year in broking. It’s not as long as most people, I suppose, but it’s been quite a journey with a lot of hours put in to get to this point, so the six years feels like a lot longer than six years for me at this point in time.

What were you doing before you were a broker?

I’ve had quite a lot of different jobs in different industries. I actually started as a bricklayer many years ago, and I did that for about seven to eight years. I bought a property when I was young and I needed some income after school to support that property. I moved through the ranks, opened my own business until I got sick of it. I also worked offshore for a while, working in mining, tree lopping, and then eventually, broking.

How did you get into the broking industry?

I got into broking through someone I knew at the gym. It seemed like he had a really good lifestyle and I became more interested the more we spoke. I ended up joining him under a mentorship and quickly realised it wasn’t what I thought it would be! It’s very hard work with very long hours, but very enjoyable, nonetheless.

What do you most enjoy about being a broker?

It’s an industry where people with limited knowledge in finance can come to you and almost entrust you with one of the largest purchases someone could make - buying a home, or with their finances in general.

It feels like I’m actually helping people improve their lives and, at the same time ,you make some friends along the way.

They’ll contact you years later to do other things, or refer you to their friends and family.

It’s funny because it’s a very intrusive industry but people still trust you with everything and you’re able to help find a way to guide them towards their goal.

It’s rewarding to help out a client without a hefty price tag attached.

How are you helping clients who a looking to build a home but are struggling due to the challenges in the construction industry at the moment?

It’s been difficult. I’m getting a lot of questions that, I personally, do not know how to answer and I end up referring back to the builder.

One thing we try to pride ourselves on is trying to work with builders who we trust. Since the builder is being referred through us, it’s almost like we’ll be seen in the same light.... so we try to assist in any way we can.

We’ll forewarn them about any possible issues, discuss past clients with them and what’s going on in regards to their situations and try to help them navigate those situations and move forward with the build.

Could you give an example of some of these challenges?

During the initial meetings, the clients have an idea of what they need, the budget they have in mind and essentially the dream home they want. We do have to give them a bit of a reality check when they meet us, though.

For example, we’ll inform them that because of the current situation with interest rates, serviceability might not be quite where it is now, and with rates increasing, their repayments could increase as well. We’d encourage them to leave a “buffer” to allow some flexibility.

Through that they’ll be able to work out what kind of builder they want, which may result in some changes from what they originally had in mind.

There are other things that pop up regarding prices, but we haven’t had any issues of builders going out of business. That's because we do have strong relationships with great builders with a strong backing.

At the end of the day, it is usually price rises that are an issue, so we do ask clients to try and speak with the builder, and include any changes in their financing at the beginning rather than them being hit with issues down the track.

Any top tips for other brokers that might be reading?

Probably my top three tips would be:

1. Be as transparent with your client as possible, never hide or neglect to give them information. The more the client knows the better it is for everyone involved.

2. Listen to the client. Make sure you’re doing what they actually listening and giving the client want they’ve asked for.

3. Give yourself no option. I quit a well-paying job before I got started in broking, and I wouldn’t be here right now if I kept that job and did this on the side. I feel that putting yourself in a situation where money is an issue means you’re going to work at your best to make things happen. That’s the biggest thing for me.

You can find out more about Adam Burstein and his top tips for success, in The Adviser’s Elite Broker podcast.

Tune in to the episode with Adam, Why WA’s Broker of the Year 2022 has customer service at his core, below:

[Related: Top WA brokers rewarded at 2022 Better Business Awards]