Recent data has suggested that asset finance is becoming increasingly sought after among small and medium-sized enterprises (SMEs), a pivot driven by the COVID-19 pandemic, low interest rates and supply chain disruptions. Sam Nichols takes a look at how this provides an opportunity for brokers.

With restrictions lifted and retail spending at record highs, businesses have been fast looking to embrace the spending spree by bringing in new stock and new machinery. As the end of the financial year fast approaches, and SMEs look at taking advantage of tax write-offs and ramp up for the new financial year, asset finance is a booming market.

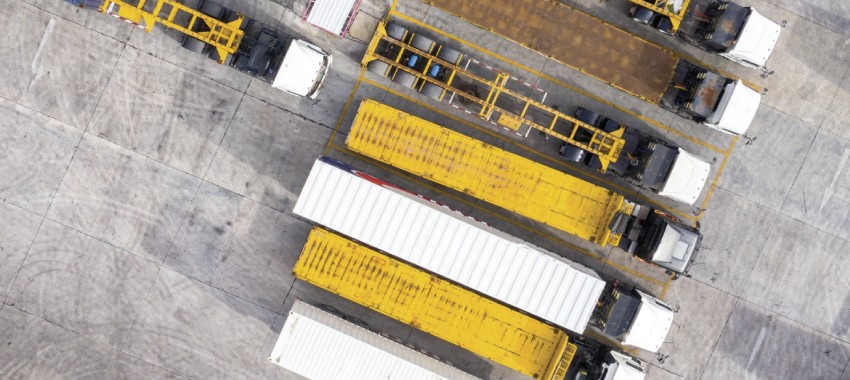

Speaking to Adviser in January, Grow Finance’s co-chief executive David Verschoor predicted that, following the omicron variant, more companies would “start to look at investing in capital assets like trucks and cranes and cars” – assets that would particularly benefit the growing demand for delivery trucks and logistics, as well as construction.

This content is available exclusively to

The Adviser premium members.

In March of this year, the Commonwealth Bank published data that explored emerging trends in small and medium-sized enterprise (SME) lending. It noted that, following lockdowns and supply chain disruptions, the demand for asset finance grew by 87 per cent during the first half of the 2022 financial year compared to the same period during FY21, and by 86 per cent period-to-period over the FY20.

“Businesses – both small and large – are now buying equipment and machinery months in advance in response to supply constraints,” Commonwealth Bank executive general manager business lending Grant Cairns said in a public statement at the time. Further data released by Commonwealth Bank in April noted that asset lending increased by 20 per cent during FY21.

This bounce upwards has been accelerated by the range of asset finance initiatives and tax write-offs launched by the federal government over COVID-19.

Key among them is the instant asset write-off scheme, which allows businesses with annual turnover or total income less than $5 billion to be able to instantly write off the cost of purchasing new capital items, helping businesses fund new purchases and investments in their growth. The scheme was extended and expanded by the government once the pandemic hit. It now allows up to $150,000 of asset expenditure for businesses earning less than $500 million in revenue – and is scheduled to continue to mid-next year.

As we enter a new rate environment, it is expected that many borrowers (whether SMEs or consumers) will swarm to take advantage of lower rates, while they still can.

Pepper Money’s general manager, asset finance Ken Spellacy, tells The Adviser: “Now, in particular, I would suggest we’re now facing a rising interest rate environment, and if [a borrower is] looking and thinking about purchasing an asset, whether it be a car or something for the business, now’s the time to do it, because interest rates will rise.

"Locking that purchasing now also gives you surety for your cash flow… for a business with your cash flow purposes, you’re looking at commitment in and knowing what that’s going to cost you going forward."

Mr Spellacy adds that while this sugar rush will fade, and asset finance will “definitely come back to more of a norm”, he doesn’t believe that the demand for asset finance will fade in the near future.

“I think supply issues and the like are still going to be with us well into next year,” he says.

“And so I do believe there is still some pent up demand for various assets across the market. I still believe that there’ll be lots of businesses looking to continue to grow their business, they’re going to need assets to help them with that endeavour that that need doesn’t go away. Even with interest rates rising.

“It just changes the structure or the amount of finance that they’re looking to acquire but the needs will still be there.”

Mr Spellacy therefore suggests that brokers should consider focusing further on the asset finance space, if they aren’t already.

“If we’re looking at the mortgage broker space, I think it’s important for [brokers] to be diversifying their own portfolio,” Mr Spellacy says.

“Rather than selling one product and being reliant on one product, they can talk to their customers about more generally what their needs are.”

Significant potential

Aside from delivering mortgage brokers a new revenue stream (particularly as the housing market appears to be cooling from its peak), the benefits of writing and offering asset finance also include stronger client retention.

Michael Moloney, the general manager of Resimac Asset Finance, explains: “Think of a self-employed customer looking to buy a new home. A broker with mortgage and asset finance accreditations, qualifications and experience isn’t limited to only helping arrange the residential mortgage – they can also offer support when their customer wants to upgrade their family vehicle or finance business assets.

“Overall, being able to offer a suite of financial products allows brokers to retain clients by offering them financial solutions for a range of assets throughout the customer lifecycle.”

According to Mr Moloney, by broadening their knowledge to cover asset finance can also help attract new customers, too.

Alex Brgudac, the chief revenue officer of SME lending platform Nodifi, agrees, stating: “The average broker can reasonably expect an annual revenue increase of up to 50 per cent if they adopt some simple marketing and process changes within their current business model to capture asset finance opportunities, amongst other product offerings such as small business loans.

“We know that 80 per cent of customers who complete a mortgage transaction are considering asset finance within nine months of settling their mortgage.”

One of the challenges rearing its head in asset finance at the moment, however, is being able to move quickly enough to secure an asset before it is snapped up by someone else. For vehicles, in particular, there’s been a surge of businesses looking to purchase electric vehicles, as petrol prices surge, but stock is moving quickly.

“This means that when a customer finds an asset, they need to move quickly so they can secure it,” Mr Moloney says.

However, he notes that asset finance does not require extensive upskilling, so brokers can take advantage of this boom very quickly.

“Mortgage brokers are already halfway there when it comes to writing asset finance, as the fundamentals are the same as for residential property,” he notes.

“Mortgage brokers are experts in understanding their customers’ scenarios and needs, and in helping develop sustainable financial solutions, and these skills are transferable to asset finance.”

Mr Brugdac likewise emphasised that a raft of support is available to brokers wishing to write asset finance for the first time.

“Most brokers would already be familiar with basic principles of taking an application and the requirements for accessing forms of credit,” the Nodifi CRO explains.

“The challenge – or the perceived challenge – in writing asset finance typically revolves around product knowledge and determining suitable lenders. However, there’s a raft of support on offer.

“Speaking to your aggregator is a great option as they can provide scenario support in addition to discussing suitable lenders.”

He adds that another pathway is embracing digital tools and platforms, too.

“Leveraging technology such as loan origination platforms and quoting tools can also provide guidance in terms of available products and way to submit applications,” he says.

Mr Brugdac notes that there is a necessity in brokers considering its potential, particularly in this current climate.

“The importance of having diversified income has been heightened in particular through the pandemic,” Mr Brugac explains, “where it highlighted the necessity for business owners to consider immediate changes to business models, service, and offerings in order to remain buoyant.”