The serviceability fintech has launched a mortgage broker community engagement function on its platform to help brokers connect.

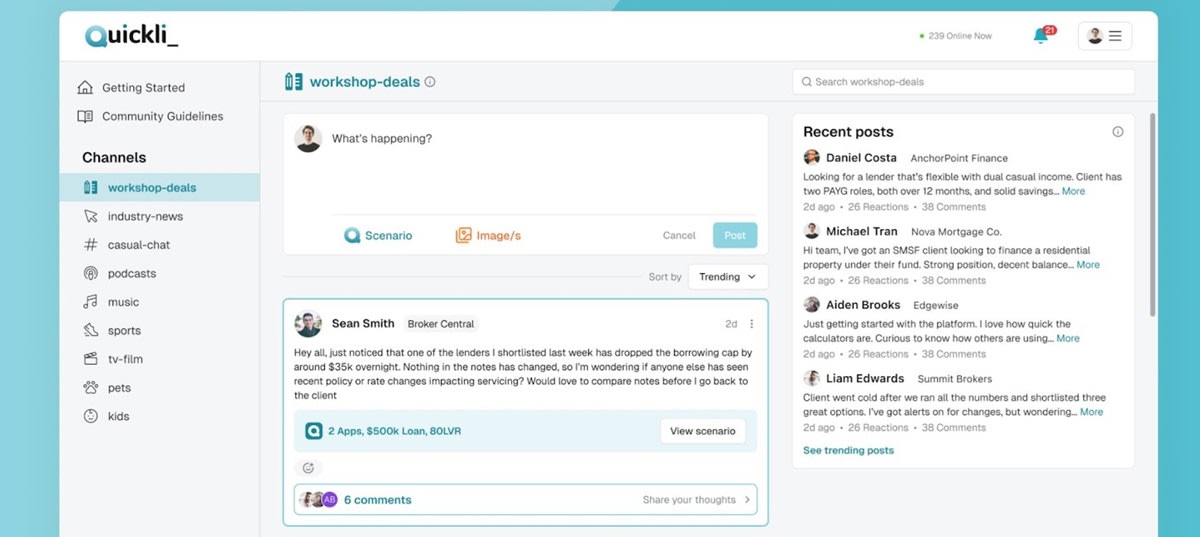

Serviceability and policy engine Quickli has launched a new broker forum, the Quickli Community, in its interface to help brokers connect with one another.

According to the platform, more than half of all mortgage brokers in the country (around 12,000 brokers) use Quickli to make quick assessment calculations and the platform wanted to help more brokers connect with one another for peer-to-peer learning.

Quickli Community aims to help brokers connect so they can easily seek assistance with complex scenarios and workshop deals from their peers. This includes being able to link directly to a Quickli scenario within the community.

The community can also be used to share wins and ask policy questions, among other uses.

Speaking about the launch, Quickli co-founder and co-CEO Angus Keatinge said the community aims to help brokers access “tribal knowledge and contextual expertise”, which he suggested can be difficult to obtain in isolation.

“We noticed brokers were naturally gathering on various external platforms to tackle complex deals and share knowledge. As we continue to work towards better supporting brokers, it made perfect sense to address this critical need within Quickli itself, where they’re already working every day,” he said.

“We recognise that brokers work best when they tap into collective expertise. Community lets brokers workshop deals, get industry news, stay connected to industry peers, and share success stories to help others learn from proven strategies.

“By building this directly into our platform, we’re creating a centralised hub where brokers can access both the tools and the knowledge they need to better serve their clients.”

Community is available immediately to all existing Quickli subscribers at no additional cost, with new users able to access the feature as part of their standard subscription.

The move is the latest in a suite of updates in the past year, including the rollout of white label widgets for broker websites that aim to help brokers attract and convert clients.

The website widgets enable broker clients to make instant calculations for:

-

Loan repayments

-

Stamp duty

-

Purchasing power

-

Borrowing capacity

-

Refinancing feasibility

[Related: Quickli rolls out white label tech for broker websites]