It was 1991 and I was working as a branch manager for Perth-based Town and Country Bank. The bank had just been bought out by ANZ and I felt it was time for a career change.

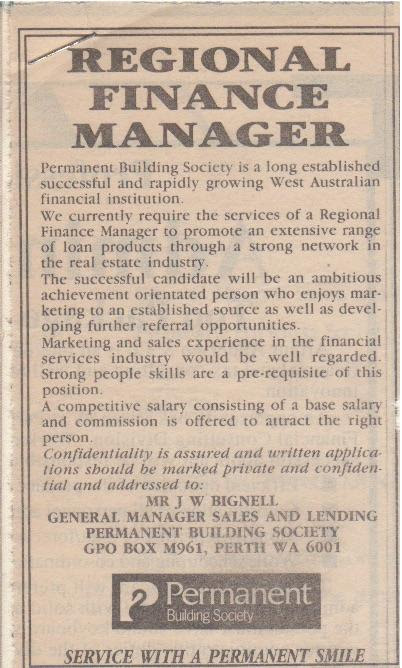

The newspaper advert below caught my eye (remember paper-based news?). Little did I know that I was to become Australia’s 8th ever mortgage broker and a dead-set pioneer of the industry.

1991 advert in The West Australian newspaper

Mortgage broking’s founding father, John Bignell, managed to convince a couple of lenders to pass on their loan application fees (anything from $250 - $400), in those days to an independent mobile lending team in return for new home loan client introductions.

Armed with pagers, loan application forms for 3 participating lenders, and of course a working motor vehicle, John’s intrepid bunch of eclectics set out to revolutionise the home loan industry. For the first time borrowers would be visited in their homes at times convenient to them. Remember, these were the days when clients donned their Sunday bests, made an appointment suitable to their local bank manager, and then on bended knee begged to be considered for a home loan.

These were heady and halcyon days, and 30-40 loans were considered a normal month for a broker. Bank managers loved us because we’d rock up to their office with a bag full of loan applications. We were treated like a member of their family and team. They all had lending approval delegations and were not afraid to use them.

After enduring the over-arching authoritarian approach by lending institutions, real estate agents couldn’t believe their luck when we rolled out the red carpet for them and their clients. We had flipped home lending on its head and life as they knew it would never be the same.

After watching us gain momentum and take business away from them, more lending institutions came on board (some very begrudgingly, even to this day) and our lender panel grew from strength to strength.

In 1997 together with Ross Begley, I [Greg Pennells] founded Choice Home Loans and Choice Aggregation Services, which we sold in 2007 to James Packer’s Challenger Financial. Which together with PLAN and FAST, they on-sold to NAB, which they on-sold to Loan Market.

After the Choice sale in 2007 I ‘retired’, but after a few years away and buying and selling a financial planning business, I realised I missed the crazy and eclectic people of the broking world, in particular mortgage brokers themselves.

I had always felt aggregators were using brokers and their loan volumes to create value in their own enterprises, and believed the time had come to create a unique aggregation business which could issue shares to its brokers as a way of creating ownership and value for them.

5 years in and I’m so proud of what we – our broker members and the wonderful team at Purple Circle Financial Services have been able to achieve in such a short time. Winner of 2020 ‘Boutique Aggregator of the Year’, Finalist of this years Australian Mortgage Awards ‘Aggregator of the Year (under 500 members)’ award, our unique aggregation platform is creating ownership and camaraderie on a level never before seen in the industry.

They say wisdom comes with age, and I think values and perspective are just as important.

Bring on the next 30 years!