Big four and non-major banks have given their reasons for delayed turnarounds for the broker channel, which vary from technology to regulation and loan complexity.

The House of Representatives standing committee on economics has released responses to questions on notice around home loan approval time frames from a number of banks.

Following requests for information on turnaround disparity between direct and broker channels, banking heads were asked to provide written responses to the committee on the reasoning for it.

The responses from three of the big four banks and several non-majors have now been published, detailing their home loan approval times for the March quarter and their reasoning for why the process has dragged for brokers.

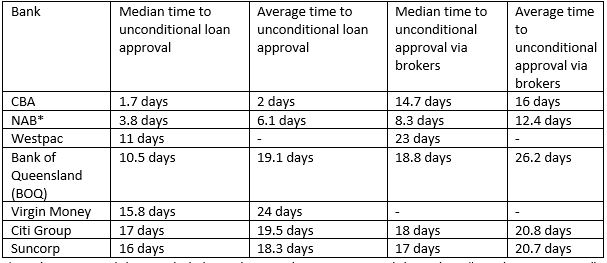

Each bank reported its median and average times for home loan approval during the March quarter, as follows:

*NAB’s response did not include home loan applications received through its “Simple Home Loans” process, which launched earlier this year. The process has seen half of eligible home loans processed in less than one day, with the remaining 50 per cent processed within five days. The bank has signalled plans to expand the process to other loan types.

CBA clocked the largest divergence between average approval time for direct and broker channels. The average time to approval via a branch was two days, whereas an application from a broker had an average of 16 days.

NAB saw its average time double between the direct and broker channels – with direct approvals taking 6.1 days, while broker turnarounds were 12.4 days.

The processing time for loans through the broker channel had increased from the first quarter of the 2021 financial year, when NAB recorded an average of 10.4 days and a median of 6.1 days.

Westpac neglected to give its average times, instead responding with its medians. The median time for a loan approval through its branches was around 11 days, compared with the broker median of 23 days.

The committee is yet to publish a response from ANZ.

Bank of Queensland, on the other hand, had an average approval time of 19.1 days for its direct channel, compared with the broker average of 26.2 days.

Why is there a gap between channels?

All of the banks with sizeable differences in turnarounds cited a spike in demand. CBA said it had experienced a 30 per cent rise in application volumes via the broker channel, while NAB recorded a 45 per rise in broker applications year-on-year.

Lenders also noted that brokers submit applications through aggregation software, which NAB commented requires a “greater amount of manual work and less automated processing” than applications received through its branches, which involve more automated verification.

“This is not informed by bank policy, but by our current technological capability and the aggregation systems used by brokers,” NAB stated.

Westpac also cited systems, saying the processes for loans could differ between channels due to the origination platforms.

But the big four bank also pointed to a gap in quality of information provided. Westpac said it is improving quality of submissions by giving brokers with “clear minimum document requirements tailored to the type of application”.

Meanwhile, CBA stated that applications from brokers tended to need more rework due to higher complexity and requirements for customer verification. According to the bank, 40 per cent of its broker applicants are new to CBA, compared to a tenth in its proprietary channel.

The bank commented that its credit policies and pricing are consistent across channels, but regulatory requirements and policies around internal systems caused differences in how applications between channels are processed.

“As an example, brokers cannot act on a bank’s behalf in relation to verifying that certain regulatory obligations have been met, such as Know Your Customer requirements. As such, all broker applications are referred to a CBA operations team for verification purposes,” CBA said.

At BOQ, loans come through a loan gateway and need to be manually rekeyed into BOQ’s home loan system by a “broker application analyst (BAA)”.

The BAA, who acts as an intermediary between the bank and the broker, adds a further step in the process that is not involved when the bank receives loans directly – because in that case, BOQ’s branch staff input the loan data directly into the bank’s systems.

All of the banks cited higher loan complexity with brokers. Westpac noted more of its broker applications involved self-employed applicants, lender’s mortgage insurance and construction loans – which take longer to process. BOQ also noted broker applications had a higher proportion of construction loans than the direct channel.

The institutions also echoed each other in saying that brokers will deal with an array of lenders – which all have differing policies and procedures.

The staff of a BOQ branch would tend to be more familiar with its policy and servicing calculations than a broker who deals with multiple lenders, the Bank of Queensland noted.

However, the banks all rejected the notion that the time difference would cut into the competitiveness of brokers.

“We know that customers use mortgage brokers for a number of reasons, including access to multiple lenders through one individual,” NAB stated.

“While the time to approval can be slow, this doesn’t necessarily make brokers less competitive, as customers save time from having one application and one point of contact for multiple lenders.”

NAB also tipped that it is building a single mortgage origination process for all application channels, including its broker network – to be made available later in the year.

The process supposedly will enable greater use of technology, minimising potential for errors and rework by brokers, and provide faster processing times.

Meanwhile, Westpac has rolled out a newly developed origination platform, which has reportedly sped up the process. The platform is currently being piloted for brokers, with the bank planning to roll it out during the rest of the year.

CBA, on the other hand, stated that it has work and investment underway in relation to its operating model, broker application system and processes, “aimed at improving data quality, the efficiency of credit officers and the processes and systems that support the broker channel”.

BOQ said it has made steps, including hiring more staff such as a coach to assist brokers on their application quality, and investing in automation to limit manual handling alongside the loan gateway and broker portal.

How other banks achieve similar turnarounds between channels

Meanwhile, Citi Group, with its lack of branches in Australia, noted that less than 2 per cent of applications it received came through its direct channel. This meant there was little difference between its broker and direct turnarounds – with the averages being 20.8 days versus 19.5, respectively.

The group reported that applications received through both channels are processed in the same manner.

Suncorp similarly had a small divergence between broker and direct approval times – with the bank commenting broker applications make up a “much larger proportion” of its overall applications.

The bank also stated there are no differences in its process between the two channels, and the “marginal” time difference should not have an impact on brokers’ competitiveness.

The big four banks and non-majors recently told The Adviser how they are addressing the channel conflict for turnaround times.

Turnarounds and what’s being done to curb them was also explored in the June edition of The Adviser magazine.

[Related: Majority of brokers believe rate is top attraction]