Major bank NAB has announced that it will increase its variable rates on new and existing residential investor home loans, including those available through NAB Broker, by 0.15 per cent on Monday.

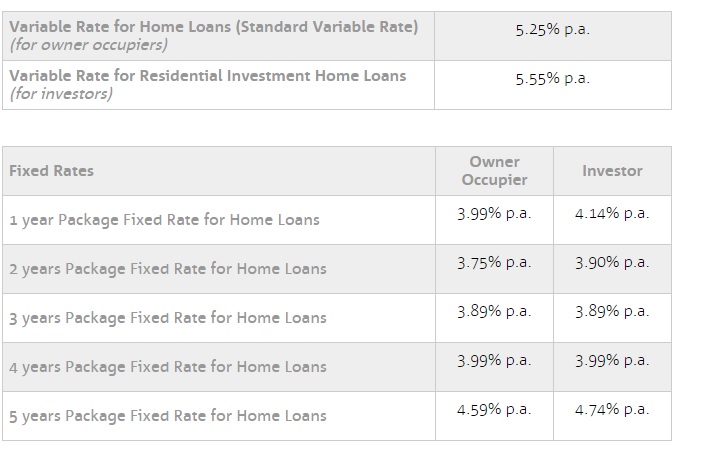

From 12 December, NAB’s Variable Rate for Residential Investment Home Loans will rise to 5.55 per cent per annum, while the variable rate for NAB Homeplus Residential Investment Home Loans, available through NAB Broker, will increase to 5.58 per cent per annum.

However, there will be no change to NAB's Variable Rate for Home Loans (Standard Variable Rate) for owner occupier customers, which will remain at 5.25 per cent.

According to NAB chief operating officer Antony Cahill, the changes “reflect the increasingly challenging environment we are currently operating in”.

Noting that the bank aims to “meet the needs of all [its] customers and [its] shareholders”, Mr Cahill conceded that the decision to raise rates was not made “lightly”.

Mr Cahill said: “As was evident during the recent bank reporting season, net interest margins – the difference between what we pay to borrow funds to lend to our customers and what our customers pay – are down, particularly in home lending, and they remain under pressure.

“A low-rate environment poses considerable challenges to all lenders, and we must respond to what is happening in the economy and the market. In doing so, we have to consider a range of factors including the ongoing need to hold longer-term stable sources of funding, continued elevated funding costs, regulatory requirements, and the competitive pressures at play.”

According to Mr Cahill, the bank will continue to “regularly review” its products and pricing to ensure a balance for borrowers, depositors, investors and shareholders alike.

The announcement follows on from changes to the way NAB prices its home loans based on loan purpose and repayment type.

“We can now be more specific in how we manage our entire home lending portfolio in line with economic conditions and regulatory requirements,” Mr Cahill said.

He suggested that some borrowers may wish to switch to a fixed rate home loan.

Mr Cahill commented: “NAB is committed to providing customers with great value and service, and home loan products that suit their needs at a competitive price.

“Switching to a fixed rate loan is a straightforward and easy process, and I encourage borrowers to speak with their banker or broker to find out more about what’s available, and if a fixed rate home loan might be right for their circumstances.”

From Monday 12 December 2016, NAB’s advertised indicator rates for home lending will include: