Annie Kane is the managing editor of Momentum's mortgage broking title, The Adviser. As well as leading the editorial strategy, Annie writes news and features about the Australian broking industry, the mortgage market, financial regulation, fintechs and the wider lending landscape. She is also the host of the Elite Broker, New Broker, Mortgage & Finance Leader, Women in Finance and In Focus podcasts and The Adviser Live webcasts. Annie regularly emcees industry events and awards, such as the Better Business Summit, the Women in Finance Summit as well as other industry events. Prior to joining The Adviser in 2016, Annie wrote for The Guardian Australia and had a speciality in sustainability. She has also had her work published in several leading consumer titles, including Elle (Australia) magazine, BBC Music, BBC History and Homes & Antiques magazines.

Keystart launches low-deposit apartment home loan

Non-bank lender Keystart has launched a two-year mortgage pilot with the Western Australian government that aims to encourage Western Australians to buy urban apartments

LENDER • Wed, 13 Jul 2022

ANZ makes bid for MYOB to bolster SME offering

The major bank is eyeing further integration into the SME finance space, as it seeks to acquire the business and accounting solutions business MYOB from KKR.

LENDER • Wed, 13 Jul 2022

Zip-Sezzle merger abandoned

Plans to merge the two buy now, pay later companies Zip Co and Sezzle Inc have been abandoned “in light of current macroeconomic and market conditions”.

TECH • Tue, 12 Jul 2022

Opening Up

Open banking and the consumer data right have been in effect in Australia for years now, but its impacts and use cases are only starting to feed through into mortgages ...

TECH • Tue, 12 Jul 2022

Billion Dollar Broker: How Deslie Taylor, Mortgage Choice Ormeau, settled $1bn in loans

Queensland broker Deslie Taylor became a billion-dollar broker after 13 years of business – no mean feat for a broker whose average loan size is around $350,000

BROKER • Tue, 12 Jul 2022

Feedback sought on how banks meet deceased estates obligations

Brokers and consumers are being asked to provide feedback to an inquiry about how banks settle financial affairs in deceased estates.

COMPLIANCE • Sun, 10 Jul 2022

Temporary CCR change brought in to protect family violence victims

ASIC has said it will temporarily allow lenders to withhold certain credit information on consumer credit reports if doing so could lead to consumer harm.

LENDER • Sun, 10 Jul 2022

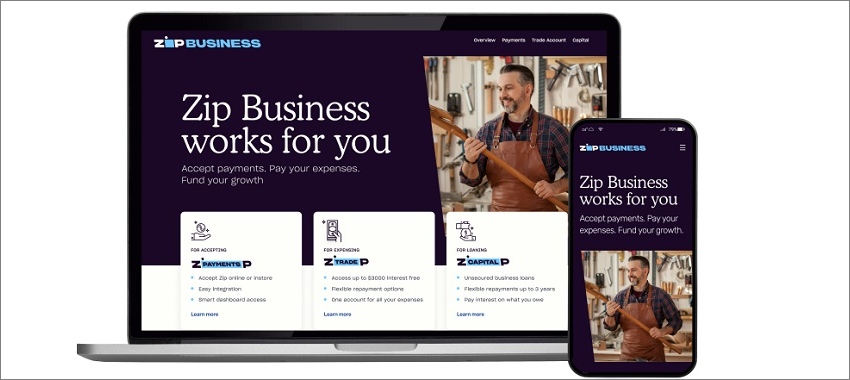

Zip to wind down SME trade finance products

Zip has confirmed that it is slimlining its SME lending arm, Zip Business, and withdrawing its trade finance products.

LENDER • Thu, 07 Jul 2022

Australia’s 1st Islamic bank will distribute through brokers

APRA has granted a restricted banking licence to Australia’s first Islamic bank, which plans to offer home finance through the broker channel.

LENDER • Wed, 06 Jul 2022