The financial services royal commission’s next round of public hearings is set to focus on loans to small and medium-sized enterprises, with responsible lending and unfair contract terms coming into focus.

The third round of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry will be addressing issues relating to small and medium-sized enterprises (SMEs) and will commence on 21 May in Melbourne.

It has now been announced that the hearings will consider the conduct of several of the leading banks in respect of their dealings with small and medium enterprises, in particular in providing credit to businesses.

The hearings will also explore the current legal and regulatory regimes as well as self-regulation under the Code of Banking Practice.

Evidence will be given by business owners and customers of their particular experiences together with other witnesses providing context for the case studies.

The entities that are the subject of such evidence will be informed by the commission.

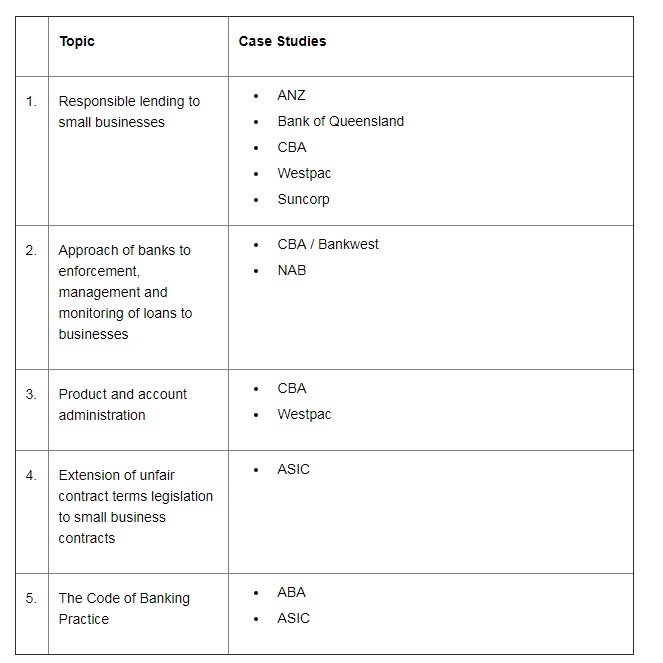

Specifically, the hearings will reference the following topics and case studies (however, more topics and case studies could be included in due course):

Prior to the commencement of proceedings, Australian Small Business and Enterprise Ombudsman Kate Carnell welcomed the commission, noting that previous inquiries had identified cases where small businesses had suffered from “questionable conduct”.

Royal commission recap

The first round of public hearings, held between 13 March and 23 March, considered issues concerning the treatment of consumers by banks and financial service providers in connection with credit products, which included residential mortgages, car finance and credit cards.

The initial round identified breaches of responsible lending obligations by Australia’s major banks and third-party intermediaries, with ANZ, the Commonwealth Bank and its third-party subsidiary Aussie Home Loans, NAB and Westpac all appearing before the commission.

The second round of public hearings, which commenced on 16 April, has investigated the conduct of financial advisers, including the treatment of consumers, compliance with the law and community standards and expectations, and the sufficiency of the current legal and regulatory structure.

Among the revelations of misconduct identified by the commission were AMP’s concession that its financial planning division charged clients “fees for no service” as well as inappropriate advice issued by advisers that adversely affected the financial wellbeing of customers.

[Related: Small Business Ombudsman welcomes royal commission]