ANALYSIS Brokers will soon experience faster and more consistent turnarounds from the non-major banks, as a tidal wave of new technology is rolled out.

The non-major banks may soon compete with the five largest lenders when it comes to turnaround times, with many turning on – or investing in – new loan origination and assessment technology this year.

Currently, the non-major banking segment has inconsistent turnarounds, with brokers often voicing frustration that a lender can reach an initial credit decision within a couple of business days in one week and then take over five days to do so the next.

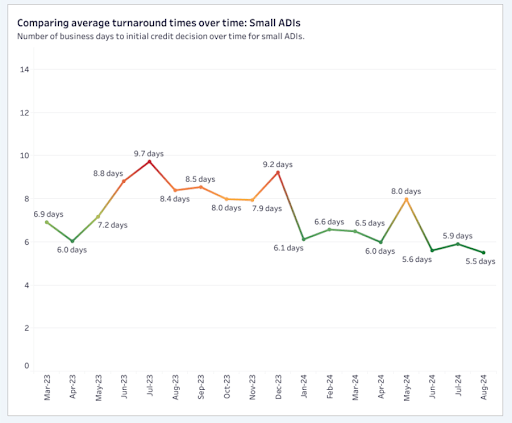

Indeed, analysis of the latest monthly Broker Pulse: Residential Lending survey from Agile Market Intelligence has found that turnaround times at larger authorised deposit-taking institutions (ADIs) are more consistent than at smaller ADIs.

According to the September edition of the Broker Pulse: Residential Lending survey (which asked brokers about their experiences using lenders over August 2024), the 277 broker respondents said that while smaller lenders have been improving their turnaround times in the past year, it can be hard for brokers to reliably estimate how long a borrower may have to wait for a lender to come to an initial credit decision.

The survey found that, over the last 12 months, the monthly average turnaround times from large ADIs have been between 5.7 and 3.6 days, with one notable peak in September.

For smaller ADIs, however, the monthly averages have been between 9.7 and 5.5 days, with several peaks and valleys throughout the year.

Source: Agile Market Intelligence Broker Pulse: Residential Lending survey, September 2024 edition.

While some individual lenders are able to reach an initial credit decision quickly (ubank and P&N Bank were leading the pack for this segment, at three business days), some non-majors – such as Heritage Bank (now known as People First Bank) – were taking an average of 10 business days to reach an initial credit decision, according to brokers.

One broker respondent told Agile Market that “time frames are a nightmare” at some of the smaller banking institutions, another lamented that “turnaround times can still be a little slow”, and a third said that “the current process for broker and customer is very painful [and] time-consuming”.

But many lenders are working on overhauling their lending and assessment systems to improve turnaround times and deliver more consistent outcomes for brokers and their clients.

Which banks are moving to new origination systems?

At The Adviser’s recent Non-Major Bank Roundtable, all seven lenders in attendance revealed they were significantly investing in technology to enhance the loan origination and assessment processes, particularly focusing on digitisation and automation to streamline operations.

MyState Bank – which reportedly took eight business days to reach an initial credit decision in August – said its “big project” for the year is working on a new lending platform and digitising and moving to automation.

Speaking to The Adviser, the bank’s head of broker distribution James Cameron said: “One of our big projects will be working on a new lending platform and digitising and moving to automation. It’s all about getting our lending platform to the point where we take away some of the work from the broker by embracing the digital side of things.

“While our service proposition has done a really good job for us up until now, by introducing digital platforms, this will help take us to the next level.”

Indeed, the bank is currently pursuing a potential merger with Auswide Bank, with MyState Bank’s CEO Brett Morgan telling The Adviser last month that one of the opportunities of a merged entity would be “being able to invest once into a more modern, better loan origination platform, which will deliver better service to our broker customers and their customers”.

“We both see the opportunity to make a step change with that and only do it once under the merger, rather than twice,” he said.

“So, this provides both of our businesses with some additional capacity to invest in a really, critically important technology and service that is important for us to keep growing up and down the eastern seaboard.”

AMP Bank – which took six business days to reach an initial credit decision in August, according to Broker Pulse – has turnaround times and consistency as a core focus for the financial year 2025. It will be moving its origination system over to Simpology this financial year and has partnered with legal services provider MSA National to “transform” the bank’s settlement process with its mortgage documentation tools and settlement services.

Speaking at the Non-Major Bank Roundtable, AMP’s head of lending and everyday banking distribution Paul Herbert said: “We’ve made some big, bold choices in the way we’re going to originate loans in the future. We’ve made decisions to change providers, not only for the origination but also our assessment platform.

“We hear the feedback from brokers about the frustration of continually having to duplicate effort and work. We’re looking at how we can pull through data to give them surety and certainty. There should be no reason why some customers can’t walk away from an interview with a broker with a loan approved (and that’s where we’re heading in 2025).”

Even NAB-owned ubank – which has one of the fastest turnarounds of the non-major banks currently (three business days) – is launching a new origination system soon.

Speaking to The Adviser, ubank’s head of broker distribution George Srbinovski said: “We will be launching a new origination system with Simpology. That’s going to be the next step forward for digital banking and digital origination, which we’re extremely excited to see rolled out … we want to see how quickly we can be through the origination process, the approval process, and the settlement process.”

What else are non-majors doing?

CBA-owned Bankwest, which is moving to become a digital-only lender with no branches, took an average of six business days to reach an initial credit decision in August, according to Broker Pulse respondents.

But the lender can now reportedly reprice in eight seconds, according to its general manager for third-party banking Ian Rakhit, who also said that the bank had recently moved its valuation tool onto the Commonwealth Bank platform, which speeds up the time to assessment and can unlock more potential for additional customers.

“We are also looking forward to widely rolling out new AI technology to ensure our offering to brokers is a secure, easy and effortless experience that meets customers’ changing needs,” he said, flagging that the bank was looking at using AI to analyse broker behaviour and proactively provide them with customer information and new valuations and pricing before they need it.

Even the non-majors with fast turnarounds have been looking at speeding up the lodgement and assessment process through other means.

Bendigo Bank – which entered the broker channel for the first time last year – has already overhauled its lending platform, with brokers the first to trial its new technology.

According to the lender’s former CEO Marnie Baker, its median time to unconditional approval is now 22 per cent faster, with a 60 per cent uplift in the volume of applications processed per day.

The bank has said that, during the pilot, the median time to conditional approval had dropped from five days to six minutes; however, brokers told the Broker Pulse survey that it was still taking three business days for it to reach an initial credit decision in August.

Bendigo Bank’s Darren Kasehagen told The Adviser’s Non-Major Bank Roundtable: “We have been investing heavily to make sure that we’ve got a strong proposition in this segment of the market.

“The bank is also investing in other technology upgrades that will make banking easier for our customers, no matter if that’s online, in a branch, or over the phone. Ultimately, we want our brokers to feel confident that once the deal settles, there is far less reason for a customer to want to leave.”

Suncorp Bank (now part of the ANZ Group) has been on a transformation journey over the last three years and already has a fairly fast turnaround time of four business days, according to the September edition of Broker Pulse.

Shane Davis, its acting head of broker partnerships, said: “We brought in a streamlined process in terms of originating home loans with our Suncorp Bank SunLight offering, leveraging the data from Comprehensive Credit Reporting. We launched our Instant Pricing Tool so brokers can get a pricing decision on new personal lending within seconds. We continue to make upgrades to our Broker Portal to allow brokers to self-service through a digital medium rather than calling through to our Broker Support team, and we’ve brought in MyPortView, which enables brokers to communicate directly with our settlements provider in real time.”

ING Australia – which was also taking an average of three days to reach an initial credit decision in August, according to the Broker Pulse survey – is focusing on new ways of accelerating the loan process.

Speaking at the roundtable, George Thompson, ING’s head of home loans, said: “When we look at transformation over the medium or long term, it’s really thinking, how do we connect this concept of product, policy and then process with automation being at the heart of what we want to do?

“We’re working hard to automate processes further so that we do even more volumes with brokers well into the future.”

Find out more about Broker Pulse and participate in future Broker Pulse surveys or read more about what the non-major banks are focusing on this year in the September edition of The Adviser, out now!

Subscribe to the print edition of The Adviser magazine to make sure you never miss an edition.

[Related: Non-major bank roundtable: HOW THE CHALLENGERS ARE CHANGING]