Chasing documentation and keeping up-to-date on lender policy changes could be a thing of the past with Valiant’s new ProductIQ tool.

Award-winning business loan marketplace Valiant Finance has extended their platform and technology to business partners including Australia Post, MYOB and Qantas Business Rewards, as well as brokers looking to expand their offering and client base.

Backed by ANZ, Westpac and Salesforce—and partnered with over 80 leading lenders—Valiant makes finance simpler and more accessible for businesses of all shapes and sizes, allowing them to cut through the red tape and get approved for the right loan.

They’ve won multiple awards in 2021 including FinTech Australia’s Partnership of the Year with Australia Post and were featured in LinkedIn’s Top Startups.

Chief Technology Officer and Co-Founder, Ritchie Cotton, explained “we wanted to extend our platform to brokers and other businesses who share our goal of helping SMEs access the right funding at the right time. Now they can tap into our offering to expand their own.”

How does Valiant’s platform work?

Valiant’s proprietary technology allows their in-house business lending experts to offer fast, flexible solutions for SMEs and make meaningful finance recommendations.

Being the first group in Australia to capture underwriting criteria and requirements from a full spectrum of loans, Valiant also offers laser-accurate quoting to customers in real time.

And now brokers can take advantage of Valiant’s tech and offer their clients the same speed and level of accuracy, whether currently in the business lending space or looking to offer their existing clients something more.

Empowering brokers with real solutions (in real time)

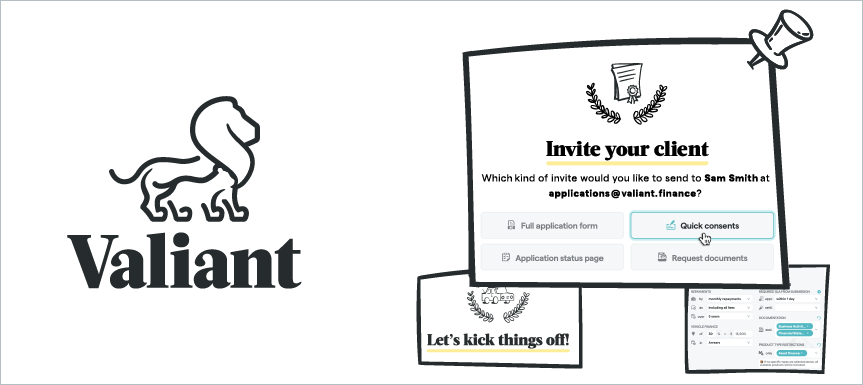

Savanna is a referral program empowering brokers to be the expert (without actually having to become one) by leveraging Valiant’s platform.

For those already working in the business lending space, the program offers a faster and easier way to track deals, keep on top of policy changes and overall, save time and hassle.

“We often saw brokers having to deal with multiple lenders on a single deal, which is not only immensely frustrating for them but limits the number of clients they can service,” Mr Cotton said.

According to Andrew Lim, Director of Third Party Distribution at Valiant, “referrers wanted to be in control of their transactions without having to necessarily be a business finance expert. We already had the infrastructure and expertise to strike this balance, so we created an alternative referral path which essentially gives brokers more control and less admin.”

Upon signing up to Savanna, brokers get accredited, plus access to:

- Valiant’s online platform where they can manage and keep track of deals in one place

- An industry-leading support team for enquiries, ongoing assistance and admin

- Valiant’s ProductIQ tool, which has been refined over the past five years to offer brokers matching technology that works in real time. And more...

What is ProductIQ?

ProductIQ allows brokers to filter products for their clients in real time based on approval SLA, document exclusions and other client needs. The tool was created to mitigate missing documentation, frequent lender policy changes and other bottlenecks often surfacing throughout the transaction process.

Savanna also works behind the scenes, adding updates to the user’s dashboard in real time so they can focus solely on their clients.

“What we’ve seen in the asset finance and working capital space is a real gap in how product matching is done, and it’s one of the reasons ProductIQ was created,” Mr Lim said.

“While there are other matching platforms out there, the key difference between those and ProductIQ is the accuracy of the solutions provided, plus the user’s ability to refine them as needed. Users can speak to their clients on the spot and have real conversations about what’s available, then and there.”

ProductIQ has proven to be a massive time saver, with working capital and asset finance settlements taking 3 days and 10 days respectively, versus 3-6 months for mortgages.

“No more chasing up lenders and clients for information, forms and documents,” Mr Cotton said. “With ProductIQ, that’s a thing of the past. Everything’s there for you, and if a client is missing something—no worries. You can add an exclusion to filter out loans that require that particular document.”

If you’d like to sign up or learn more about Savanna, Valiant is currently offering an in-depth demo of the platform. Follow the link below to book yours in and a Valiant BDM will be in contact to walk you through the platform.

Brokers who have signed up to Savanna are already pocketing an average of $2100 per deal.