Promoted by Joust

Digital marketing trends move at an increasingly fast pace. In the post-COVID era, there has never been a greater need to connect with customers digitally. How can small businesses generate quality home loan leads and great ROI online?

In the current uncertain environment, as interest rates hit record lows, Aussie home owners are increasingly looking to refinance. The current economic environment also means that, for small and medium-sized businesses, the need to digitise and build automation has never been greater.

Google research on the behaviour of customers looking to refinance shows that:

- Nine in 10 Australians research online when they are looking to refinance their home loan.

- Of the top five most common resources Aussie refinancers turn to during their research, four are exclusively online.

- 70 per cent of refinancers decide on a lender within a week and, on average, consider 2.6 providers as part of the decision journey (this is down from 4.6 in 2016).

Online is now the predominant research channel for consumers when refinancing, and compared with four years ago, they are taking significantly less time, and only considering half the number of providers.

In such a dynamic and competitive environment, how does a business effectively generate quality digital leads and ensure they are part of the consideration set?

As technology is further adopted throughout the industry, the real differentiator will be knowledge, experience and customer service. Technology won’t replace what a broker does – it will simply enable them to do it more efficiently, so they can spend more time helping customers.

The process of acquiring new online leads and converting them into settled loans with most ‘traditional’ online channels, such as lead gen agencies and comparison sites, is highly competitive and inefficient. The costs of generating qualified leads are extremely high and, typically, they have low conversion rates.

If a business wants to undertake their own digital marketing, investment in specialist staff or skills are required to deliver results in a saturated market.

Businesses need to consider how they can partner on digital lead generation, and then be confident that they can receive the right volume of quality home loan leads that allow them to optimise all their other resources.

Joust Instant Match helps provide that partnership solution, and does so at a scale that allows small to medium-sized broking businesses to effectively compete with larger-scale players in the market.

Find Out More About Joust Instant Match

About Joust Instant Match

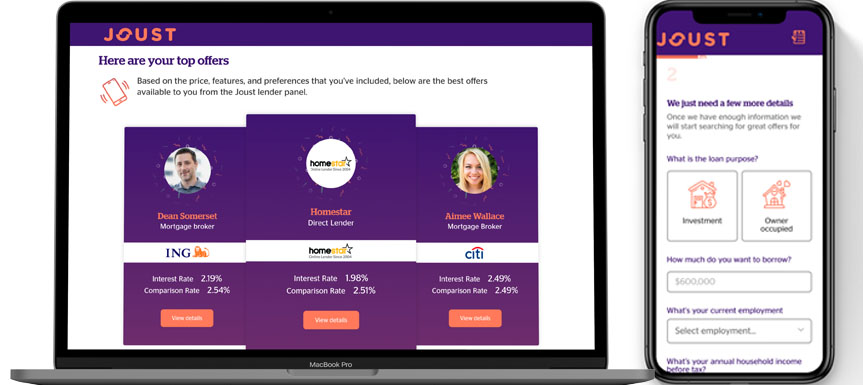

Joust Instant Match allows consumers to immediately scan the market for three home loan products that most effectively meet their needs.

The customer enters 10 data points into a simple onboarding form – loan type, property value, income, priority loan features etc – and they are instantly presented with up to three different products that meet their requirements and best match their profile.

The offers are algorithmically matched based on the data supplied, the customer is SMS-verified, and the customer and the supplier are immediately connected to take up discussions.

Providers can opt into Joust Instant Match on a cost-per-lead basis, and orders can be ‘turned on and off’ based on their pipeline requirements. Providers are also able to filter and target the types of customers they receive, ensuring good ROI on the leads that land into their system.

As the system works on a pay-per-lead basis, and Instant Match is able to work with lenders on volume and timing, brokers are able to ensure there is little wastage, and that they grow their investment in line with their pipeline.

Joust Instant Match features and benefits

- Generally, reducing the cost per lead by 70 per cent compared with other lead sources.

- Scalable, high volume and results-driven.

- Borrowers use this tool to instantly connect and engage with lenders.

- Customisable filtering and targeting based on multiple data points.

- Quick and easy to set up and run.

- All user mobile numbers are SMS-verified.

- No ‘promoted offers’. All offers are displayed without any preferences according to the user profiles.

Why is three the magic number?

Joust Instant Match provides its online customers with matched offers from up to three different providers.

Our R&D suggests that when a customer knows that Joust has facilitated three offers based on their profile and preference, and that there will be a strong level of competition to contact them, they are generally satisfied that their testing of the market is adequate.

It is this unique customer expreience that has the effect of taking these consumers “out of the market” (making them less likely to respond to further targeting via social media channels) more quickly than other online experiences.

Using data as a differentiating factor

The ability to target a certain quality of lead or a certain demographic profile is of vital importance – particularly to smaller broking firms.

Joust Instant Match provides businesses with the capability to target specific geographic regions, certain loan-to-valuation ratios, loan sizes, household incomes and home loan types.

This type of targeting not only provided for a greater quality of lead, but also ensures a much stronger customer experience.

“I find most Joust customers that come through the Instant Match solution are actively looking to do something and are expecting a phone call from me to discuss loan options with them,” says broker Michael Chadwick. “This has been a good solution to help drive business volumes now as well as build a database of active customers to write business in the future.

“I have used a number of online providers that provide home lending leads through loan comparison websites and the like,” says Mr Chadwick. “I find the data targeting that Joust Instant Match provided produces customers that convert at a higher rate than the other providers, which is generating more revenue and a much better ROI for my business.”

In the ongoing search for quality leads, a strong return on marketing investment and a high converting pipeline, businesses should ensure that they are able to partner with specialists that can help them scale in the digital environment, which then allows them to focus on their core business of great customer service.

Top three tips to converting digital leads

- Contact fast. Speed is key.

- Always use a good script as a guide when having that first contact and refine it as you analyse your results.

- Have an excellent lead nurturing program for those leads who are not ready yet/uncontactable. This will help build a long-term database of users.

Find Out More About Joust Instant Match

Carl Hammerschmidt

, CEO, Joust