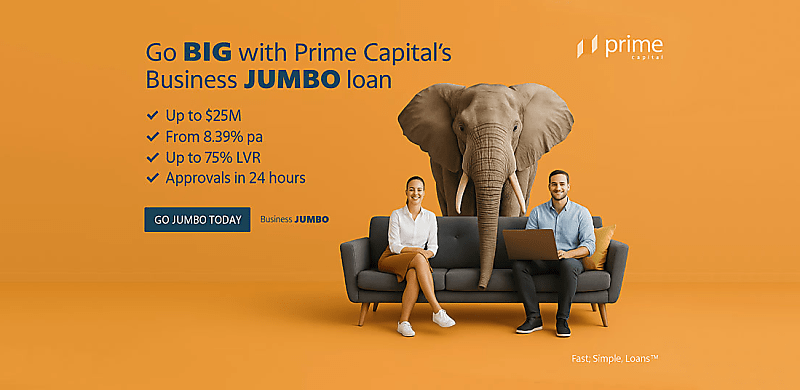

Need $5M–$25M in funding? Prime Capital’s Business Jumbo loan helps brokers close large-scale commercial deals quickly – with real approvals and flexible terms.

Big Funding, No Roadblocks: How Prime Capital is changing the game in Commercial Lending

In today’s tightening credit environment, many business clients are being turned away from traditional banks – not because their deals aren’t strong, but because they don’t fit the mould. When it comes to large-scale funding, there’s a clear gap in the market between what businesses need and what most lenders are willing (or able) to provide.

Prime Capital is stepping in to close that gap with a commercial lending solution designed for scale, speed, and flexibility.

A purpose-built product for high-value deals

Prime Capital’s Business Jumbo loan is specifically tailored for businesses looking to secure large amounts of funding quickly – without the red tape. It supports loan sizes from $5 million to $25 million, with approvals in as little as 24 hours.

Whether it’s for property acquisition, refinancing, or expansion, the product is designed to help brokers support clients who need serious capital and a lender that moves fast.

Key features include:

-

Loans from $5M–$25M

-

Rates from 8.39% p.a.

-

Up to 75% LVR for residential security, 65% for commercial security

-

Available in metro areas

-

Interest-only terms from 6 months to 3 years

“Brokers are seeing more clients with strong equity, clear business plans, and time-sensitive opportunities – but they’re hitting walls with rigid credit policies,” said Prime Capital CEO Steve Sampson. “That’s where we come in. Business Jumbo gives brokers the confidence to say yes to deals that would otherwise stall.”

Real solutions, not hypotheticals

What sets Business Jumbo apart isn’t just the loan size – it’s the way it’s structured. The product allows for flexible terms, supports complex deal scenarios, and moves fast, with a credit team that works in real-time alongside brokers to find the path to approval.

That kind of speed and responsiveness has already helped brokers close high-value deals across Australia. One broker recently used the product to secure funding for a logistics client whose bank had rejected their application due to non-standard income. With Business Jumbo, the deal was assessed on its merits, approved, and funded – fast.

Making approvals even easier with Prime Approve

Prime Capital has gone a step further with Prime Approve – a digital tool that lets brokers submit a deal and receive approval within minutes.

With no paperwork required and no need to wait for a call back, Prime Approve is available anytime, from anywhere – designed to help brokers work smarter and win more business, even on the go.

“Whether it’s a jumbo deal or something smaller, our goal is the same,” Sampson added. “We make it simple for brokers to deliver fast, tangible outcomes to their clients – and we back them with tools, people and products that actually get deals done.”

Prime Capital: Built for brokers

With over 27 years in the game and more than $3.7 billion in loans settled, Prime Capital is a non-bank lender that works exclusively with mortgage brokers to support Australian businesses. Their full range of products is backed by deep commercial experience, a responsive credit team, and a commitment to speed.

“We’re not here to replace banks—we’re here to offer a better option when banks can’t deliver,” Sampson said. “And we’re just getting started.”

Download Prime Capital product guide

Submit a deal now via Prime Approve