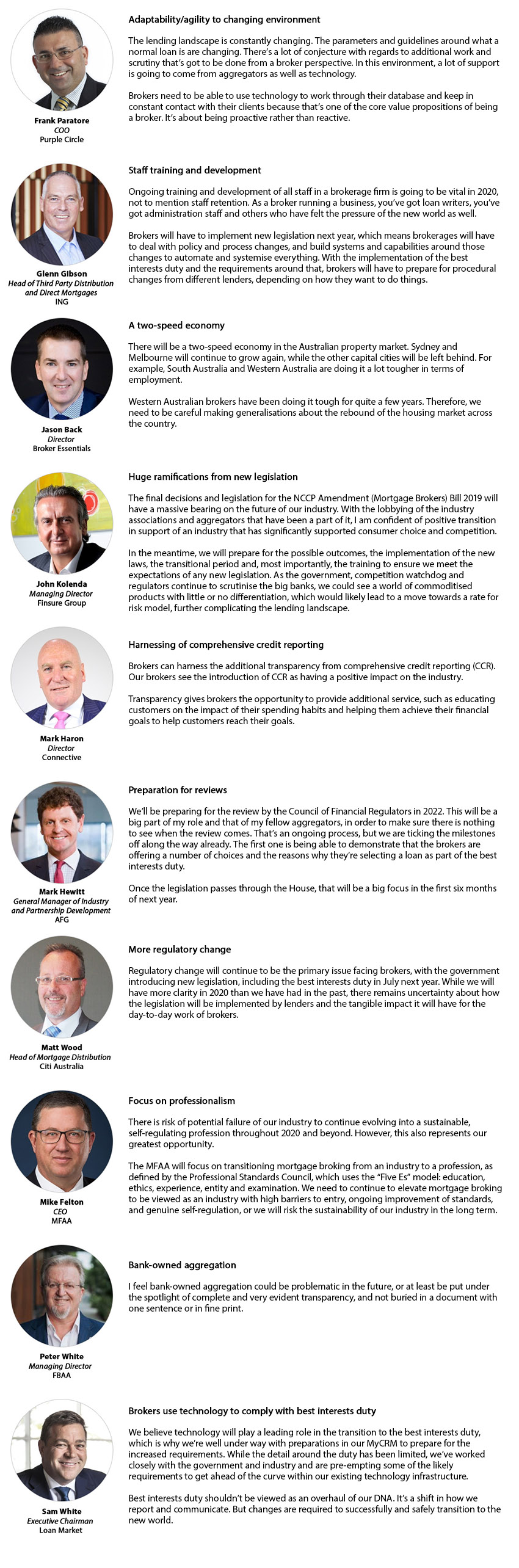

As we start the year 2020, we ask industry heads what they predict will be the biggest themes of the year.

Common ground

Several commentators agreed on common themes for the year 2020.

An increase in broker market share

Both Sam White and John Kolenda expect market share to increase.

Mr White said: "For every broker in Australia, the priority will be to focus on growing and expanding their business and proving excellence in service to the market while continuing to put the client’s interests first. We need to be aiming for no less than 70 per cent of mortgages being originated through mortgage brokers and letting our value proposition and professionalism drive our future."

Mr Kolenda added: "Despite the many challenges ahead, we are seeing an increased number of broker businesses reaching maturity levels and the overall market share will continue to increase steadily. Consumers will favour brokers over all other channels because they have the expertise to help them navigate highly complex borrowing scenarios, and this will get further complicated in the future."

Consolidation of the sector

Both Frank Paratore and Jason Back foresee brokerage consolidation.

Mr Paratore said: "With increased costs coming in the industry, including compliance costs or costs of doing business, brokers are looking for operational efficiencies and support. I think the days of the one-man band per se are probably numbered. Brokers might deem it more sensible to work collaboratively under one roof or one environment where they can share costs. For example, three or four brokers might be able to share resources for loan processing; it might not be feasible for them on their own, but it might make sense as a shared resource as it might help them with their productivity and compliance. There has also been the emergence of the para-broker and loan processing services like xSource, which allows staff at the back end to look after loans processing, follow up and research using IT."

Mr Back commented: "Questions will be raised over the viability of the sole operator. It’s a more complex market, which means we will continue to consolidate in the broker sector. Brokers need to be adapting to the changes instead of resisting. Their cost-to-income ratios will come under more pressure if they don’t work smarter on their businesses. Remember, there are tens of thousands of brokers and bankers all trying to sell homogenous debt products, so it’s a very competitive space. There will be a shift in the coming years where new brokers will enter as loan writers. It will be aspirational to enter commissions-based broker roles, and it will take a few years."

Are you interested in the issues shaping the roles of mortgage and finance brokers? Don’t miss your chance to hear about all the big ideas for the year ahead, and gain the tools you need to position your business for growth and prosperity. Book your ticket to the Better Business Summit today.