Consumer demand for mortgages rebounded strongly in the December 2016 quarter, creating a “stronger trend than expected”, according to the latest findings from Veda.

The Veda Quarterly Consumer Credit Demand Index saw the annual rate of growth in mortgage applications strengthen from 0.9 per cent in the September quarter 2016 to an annual rate growth of 6.6 per cent in the December quarter.

Strong mortgage application growth was seen in most cities, particularly NSW, Victoria, Tasmania and the ACT.

The strongest growth was seen in the ACT, which posted a growth in demand of 14.9 per cent over the quarter (compared to the same period the year before). This was closely followed by Tasmania, where demand for mortgages increased by 11.2 per cent.

Victoria, NSW, Queensland and South Australia also saw mortgage applications grow by 10.6 per cent, 9.6 per cent, 5.8 per cent and 3.3 per cent respectively.

Meanwhile, mortgage applications continued to fall sharply in Western Australia (-10.6 per cent) and the Northern Territory (-10.8 per cent).

Commenting on the findings, Veda general manager of consumer risk Angus Luffman emphasised that the result represented a “stronger trend than expected given recent trends”.

Speaking to The Adviser, Mr Luffman said: “We’ve seen growth in applications for mortgages of 6.6 per cent, which is stronger than more recent trends, which have been… generally positive in the last three or four quarters after the big run up in the back half of 2015.”

“This is a lead indicator, so the first quarter that it jumps back up again is always interesting. It’s an indicator of activity,” he elaborated.

“There has been an increase in activity in the December quarter. Given its reversal or change of the previous trends, it’s going to be interesting to see how that flows into subsequent quarters given it’s a bit of a turnaround quarter.”

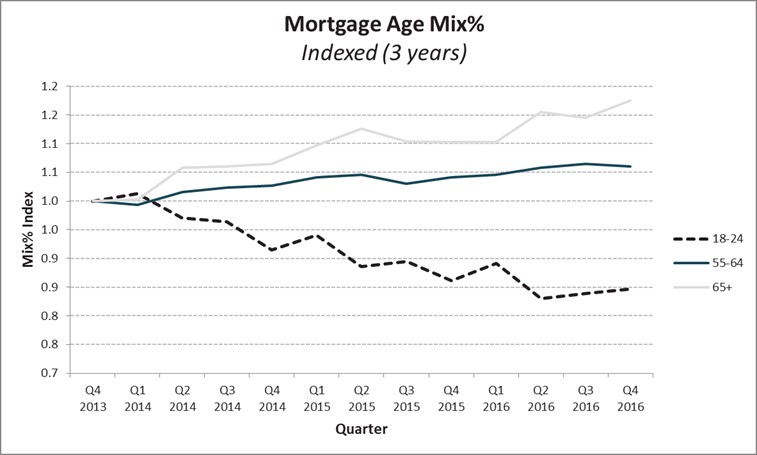

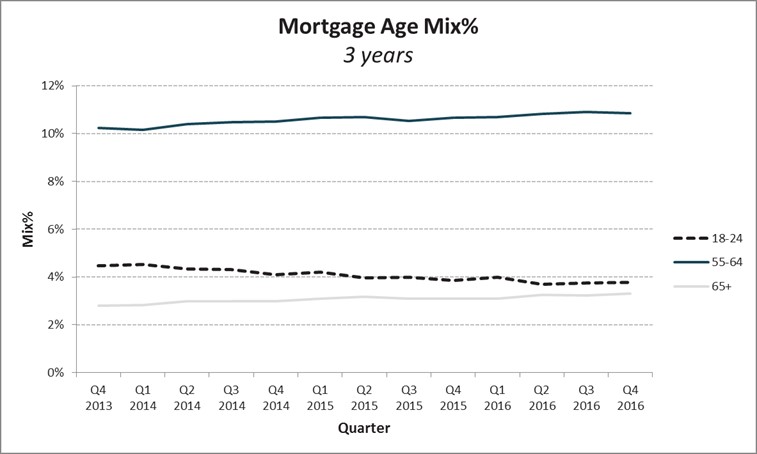

He noted that the data showed a lower set of activity in terms of the proportion of credit enquiries in the 18-24 age bracket, and a higher proportion in the 55+ and 65+ age brackets, which suggested that investor lending could be driving the surge in activity.

“Veda’s data showed older demographics growing once again in relative mortgage application demand, which supports the rise in investor mortgage activity. The younger demographic volumes have remained static despite the rest of the market growing,” he said.

“Similarly, ABS data revealed a steep increase in the value of loans to investors, and a simultaneous fall in the value of new housing finance commitments to owner occupiers in November.

Mr Luffman concluded: “Considered together, the Veda and ABS findings illustrate the difficulties younger home owners and first home buyers continue to face.”

[Related: FHBs waiting longer to enter property market]