YBR has added to its lender panel in a move to offer more niche lending options.

Aggregator Yellow Brick Road (YBR) has added two businesses to its lending panel and launched a new broker mentoring program.

Both private lender Archer Wealth and no-deposit home loan lender Empower Money joined the panel in a move to widen options for YBR and YBR Aggregation brokers, providing finance to first home buyers and those with low savings.

Archer Wealth focuses on providing bespoke lending options for borrowers who don’t meet the more rigid requirements of major lenders, particularly business owners and developers who need quick decisions and tailored terms.

Archer’s addition to the panel reflects a growing appetite in the market for non-bank and private lending options in the face of stricter lending policies among mainstream lenders, YBR said in a statement.

Meanwhile, Empower Money aims to help borrowers, including first home buyers and those with low savings, to overcome the deposit barrier driven by high property prices.

The Sydney-based lender offers up to 105 per cent finance, covering the full purchase price of approved properties and associated risk fees (lender’s risk fee), eliminating the need for a traditional deposit.

The lending product is restricted to vetted new dwellings, including apartments and house-and-land packages and offers a 6.95 per cent interest rate.

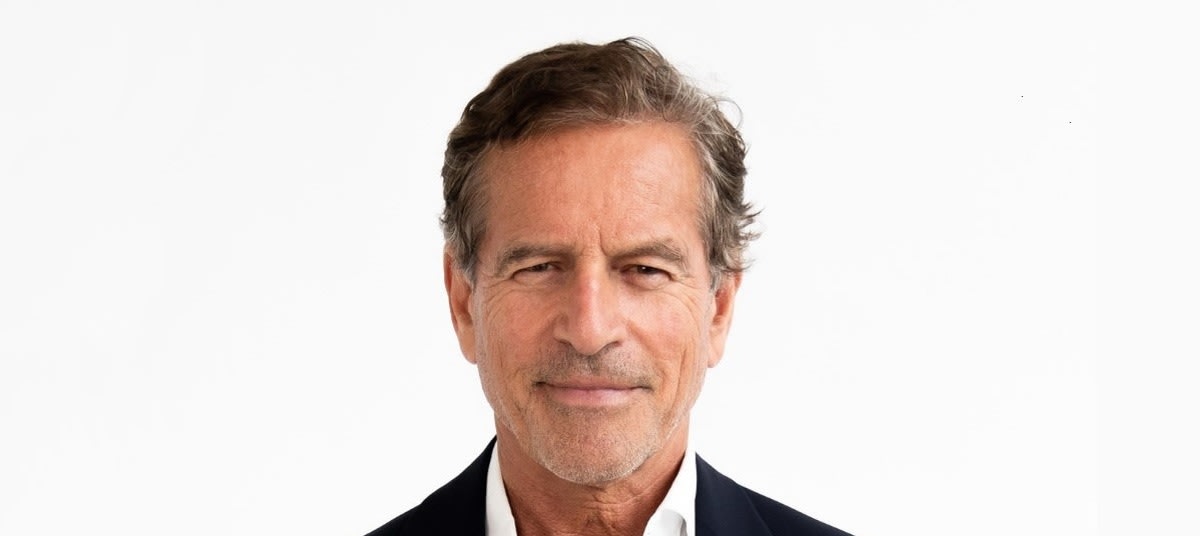

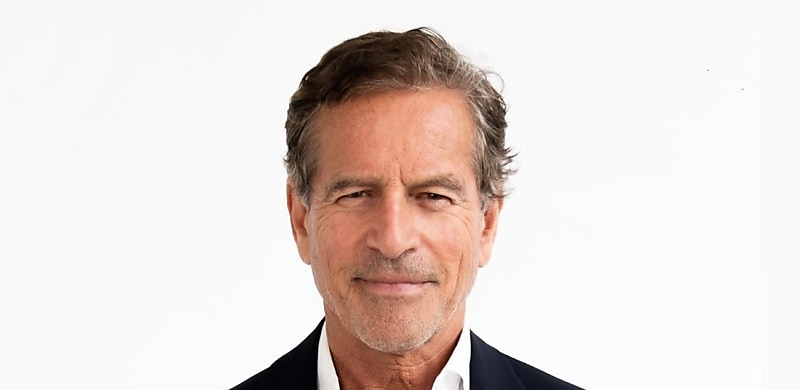

Commenting on the move, Mark Bouris, YBR executive chairman, said: “Our role as an aggregator is to provide choice in lending options to our network of brokers. Partnering with Empower Money gives the network the ability to service a huge new market – borrowers who are 10 years away or less from having a deposit.

“With every year that passes, there’s a new crop of borrowers potentially being locked out of the market. This new generation needs these kinds of lending products to help them climb the property ladder.”

Peter Khoury, Empower Money chairman, added: “YBR’s brokers have a national reach but are also an integral part of their local community. Working with brokers who have close relationships with borrowers, will allow us to build trust in a product that might initially seem too good to be true.”

Bouris also welcomed Archer Wealth to the YBR panel.

“Archer Wealth fills a real gap in the market,” he said.

“Their personalised approach to credit, quick settlements, and deep understanding of borrower needs makes them a valuable addition to our panel. Their inclusion expands the options available to brokers looking to help clients move quickly on time-sensitive opportunities.”

Gee Taggar, founder and managing director of Archer Wealth, added: “With this partnership, we’re in an even stronger position to support brokers and borrowers across the country.”

YBR has been expanding options for brokers this year. Last month, it announced a new white label partnership with non-bank lender Thinktank in a move aimed at expanding the lending options available to brokers on its network.

YBR and Mr Mentor partner

The aggregation and brokerage group has also announced a new partnership with mortgage broker training organisation Mr Mentor to launch the YBR Broker Pathway Program.

The initiative, now open to enrolments, offers training and mentoring to develop and support mortgage brokers entering the industry via a structured two-year pathway.

YBR said brokers on the program will benefit from integration into the YBR network and from being paired with an experienced industry mentor for business, compliance, and deal coaching.

Established YBR brokers will also benefit from the partnership with access to Mr Mentor’s ongoing professional development and broad training platform, the aggregator noted.

“This partnership reflects our commitment to investing in broker development,” said Peter Bryant, head of YBR Aggregation.

“We know that success as a broker requires more than just getting accredited, it’s about being supported from the ground up, and Mr Mentor brings unmatched depth in that space.”

Melissa Robinson, director of Mr Mentor, added: “YBR’s reputation and national presence make it an ideal partner for brokers building a future in the industry.

“Together, we’re offering a launchpad that goes beyond minimum compliance – this is about creating capable, confident brokers who will succeed for the long haul.”

[Related: LMG adds Moneytech to lender panel]