APRA has released data on the exposure to property of Australian authorised deposit-taking institutions.

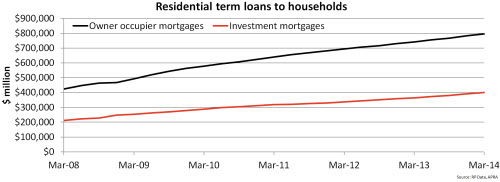

The data showed that at the end of the March 2014 quarter, there was $1.2 trillion worth of residential loans to households across Australia, up from $1.17 trillion at the end of 2013.

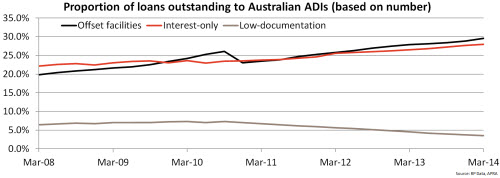

Focusing on the total value of lending, 35.4 per cent of the outstanding loans to domestic ADIs have an offset facility and 35.4 per cent are interest-only mortgages. The proportions of each are at a record high level currently. On the other hand, only 3.1 per cent of mortgages are low-documentation loans, which is at a historic low proportion. Just 0.1 per cent are other non-standard loans.

Looking at the number of loans, 29.6 per cent of all loans have an offset facility and 78 per cent have a re-draw facility. In terms of the number of loans, 28 per cent are interest-only mortgages and 3.5 per cent are low-documentation loans. The proportion of loans with an offset facility and the proportion of interest-only mortgages are at a record high while the proportion of low-documentation loans is at a record low.

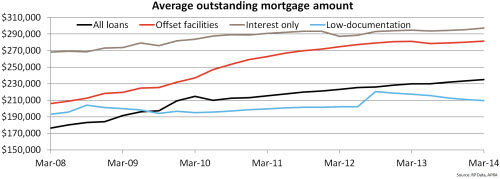

The average outstanding balance for residential loans was recorded at $235,000 at the end of March 2014, up from $233,500 at the end of 2013. Loans with an offset facility ($281,400) and interest-only mortgages ($297,200) have a much higher average balance than the average across all loans.

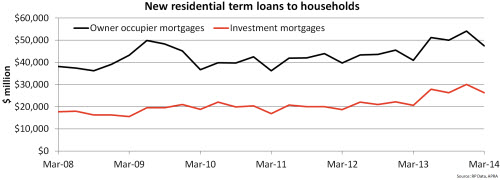

Over the first quarter of 2014, there was $73.8 billion in new residential mortgages, down from $84.2 billion over the final quarter of 2013. Of these new loans, 64.3 per cent were to owner-occupiers and 35.7 per cent were to investors.

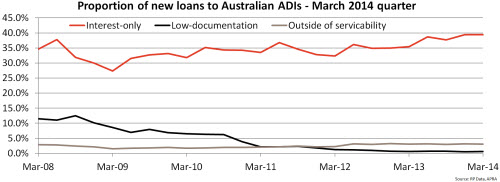

As I mentioned previously, the proportion of interest-only loans which were outstanding to banks was recorded at 35.4 per cent (based on value); however, interest-only lending was much higher over the quarter, with 39.4 per cent of new loans interest-only loans.

It is clear that low-documentation loans are becoming harder to receive. Over the March 2008 quarter, 11.5 per cent of loans were low-documentation; over the most recent quarter just 0.6 per cent of new loans were low-documentation. Over the quarter, 3.1 per cent of loans were approved outside of serviceability, which was steady over the quarter. The proportion of loans approved outside of serviceability has been higher than it is currently but was consistently lower than 3 per cent of all loans before the June 2012 quarter.

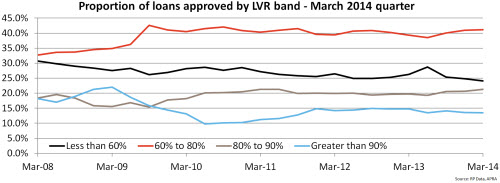

The level of higher LVR lending also increased over the first quarter of this year, with 34.8 per cent of new loans having an LVR of 80 per cent or more, up from 34.2 per cent over the previous quarter.

The proportion of new loans with an LVR of more than 80 per cent is at its highest level since the December 2011 quarter (34.9 per cent). Although higher LVR lending is increasing, the proportion of loans written with an LVR of 90 per cent or more was recorded at 13.5 per cent, down from 13.6 per cent the previous quarter. This indicates that there is growth in the 80-90 per cent LVR segment, which accounted for 21.3 per cent of new mortgages over the quarter, up from 20.7 per cent the previous quarter. The proportion of new loans with an LVR of between 60-80 per cent accounted for the largest proportion of new loans at 41.2 per cent and sitting at its highest proportion since September 2011 (41.5 per cent).

By combining the latest data from APRA with recently released data from the ABS, you get some really valuable additional insights into the exposure of Australian authorised deposit-taking institutions to residential property.

The ABS estimates that there were 9.3 million residential dwellings in Australia at the end of March 2014 and the latest APRA data highlights that there were 5 million outstanding mortgages at the end of March 2014. This indicates that only 53.6 per cent of all dwellings nationally have a mortgage. Of course, as you can see from the chart which follows, the proportion of mortgages properties is rising.

The ABS estimates that the total value of residential dwellings across Australia was $5.1 trillion at the end of March 2014. Pairing that with the value of outstanding mortgages reported by APRA at the same time ($1.2 trillion) it indicates that only 23.4 per cent of the value of Australian housing is mortgaged to Australian authorised deposit-taking institutions. This analysis highlights that for better or worse, Australians store significant wealth within their residential properties.

Overall, the data indicates that the proportion of interest-only lending and loans with an off-set facility is increasing. No doubt APRA will have a close eye on this phenomenon, particularly interest-only lending which is inherently more risky than when both the principal and interest is repaid.

The majority of new mortgages are written on an LVR of less than 80 per cent. However, the rising proportion being written between 80-90 per cent will no doubt be closely scrutinised.

It is encouraging to see that there are fewer new mortgages being written with an LVR above 90 per cent. Although the current value of housing compared to that mortgaged is relatively low, a sharp downturn in property values would have a significant impact on more recent purchasers. The first five years of a mortgage is inherently the riskiest. Whilst those who have owned their home and have significant equity within it can weather a downturn, recent buyers with little or no equity, and those who have leveraged their equity for other investments, are significantly more exposed in the event of a downturn.

Cameron Kusher, senior research analyst, RP Data

Cameron Kusher, senior research analyst, RP Data

Cameron Kusher is RP Data’s senior research analyst, specialising in primary and secondary data analysis, property market commentary and consultancy. Cameron has a thorough understanding of the fundamentals such as demographics, trends, economics and spacial analysis and is a regular keynote speaker for property-related groups, regulated industry bodies, corporations and the government sectors.