Starting a business is one of the most rewarding things you can do, but it also comes with a lot of hard work and responsibility. So when you’re setting up a franchise, having the right support and backing can make all the difference.

Running your own broking franchise means you get to be your own boss and shape your work to fit the kind of life you want to lead. But you also don’t have anyone to defer to when it comes to making major decisions and, as with any business, there’s no guarantee that all your hard work will pay off.

That’s why it’s so important to have the right partner who can provide the expertise, support and encouragement you need to thrive. Mortgage Choice is one of Australia’s highest performing mortgage broking franchise networks. Backed by the power of REA Group, a global leader in digital property, we’re creating a wealth of new opportunities for brokers.

Anthony Waldron, CEO of Mortgage Choice and Financial Services, says, “Mortgage Choice has a 30-year track record of building successful small businesses while helping hundreds of thousands of Australians achieve their property ownership dreams. Our rich heritage and ownership by REA Group mean we’re in an unrivalled position to create better broker and client experiences.”

Here are just some of the ways Mortgage Choice will help set your franchise up for success.

Choose how you want to work

As a franchisee, you’re a fully-fledged business owner – so you’re in the driver’s seat. You can build in flexibility around when and how you want to work, the services you offer and the type of clients you cater to.

There are plenty of franchise structures out there, but with Mortgage Choice you’re free to run your business in the way that works best for you:

- Take over an existing business. You’ll hit the ground running from day one, with access to existing clients, systems and an experienced team. Mortgage Choice can match you with a business that aligns to your vision and goals.

- Start your own shopfront office. This option takes a lot of work upfront, but it also gives you the opportunity to tailor your business to suit your lifestyle. With Mortgage Choice, you have access to specialist support to help you get set up.

- Work from home. If you prefer to work from home and minimise operating costs, this might be a great option for you. You can work from your home office and travel to visit clients, with access to all Mortgage Choice’s systems, data and support on the road.

Receive ongoing support, tools and coaching

As a Mortgage Choice broker, you drive your business but you’re never on your own – our experts are in your corner every step of the way. Right out of the gate, you’ll be paired with a dedicated onboarding manager to help you put together your roadmap for success, so you know what your goals are and how you’re tracking towards them.

When you join the Mortgage Choice broker network, you tap into a wealth of expertise and resources to make sure you have the knowledge and skills you need to run a successful franchise.

Here’s what you can expect:

- Structured induction program. Learn what’s involved in becoming a broking business, including compliance requirements and lender accreditations.

- Tailored marketing support. Access to a suite of innovative marketing tools and training in customer engagement, to help you boost your profile and win new business.

- Efficient broker platform. Start writing loans from day 1, and stay on top of your workflow, processes and database with ease.

- Ongoing training and development. Our 5 Pillars of Broker Success Framework is custom-designed to scale your business for growth – whatever that means for you. And the rubber hits the road with our comprehensive programs that provide you with tailored support throughout the life of your business.

- Specialist coaching. In-depth support across a range of business areas, from sales and marketing to systems and business management.

- Backed by REA Group. Our ownership by property giant REA gives our brokers access to the 12.7 million highly engaged property seekers who visit realestate.com.au each month, helping to make finding the right loan part of their property journey.

Drive business growth

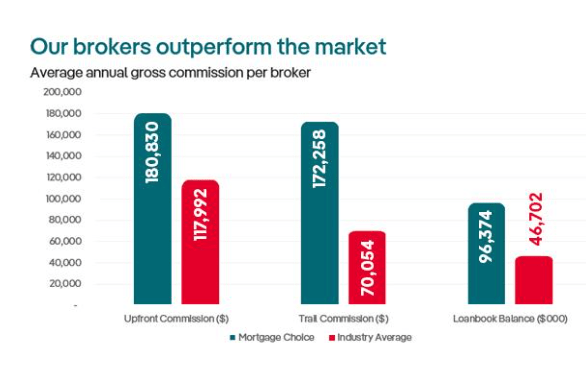

A 2021 industry report revealed that Mortgage Choice brokers outperform the market, earning upfront commissions of $180,830 and trail commissions of $172,258 on average – compared with $117,992 and $70,054 respectively across the industry. What’s more, the average Mortgage Choice broker loan book balance is more than double the industry average at $96,374 compared with $46,702.

*Industry Average based on MFAA Industry Intelligence Service 13th Edition (1 April 2021 – 30 September 2021)

Find out more

To start building your own successful business, book an appointment with a Mortgage Choice specialist today on 1300 650 330 or at click here.