What do brokers like most at Westpac?

1. Significant service improvements and speed

IMany brokers highlight a “massive turnaround” in Westpac’s service over the past 12–24 months, praising their increased speed, competitive pricing, and overall reliability, making them a preferred lender for many.

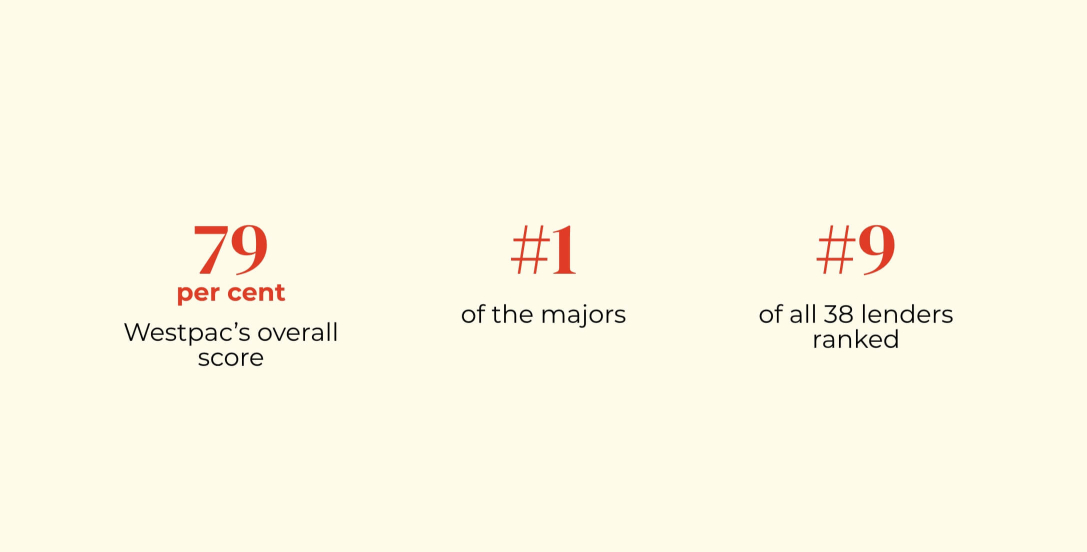

Westpac was rated higher than average for products, speed, and technology

2. Excellent policies and credit hotline access

Westpac is frequently commended for its “great allrounder policies” and good credit policies. Brokers also value the “good access to credit via hotline” for scenario discussions.

3. Positive overall experience and competitive pricing (for some)

Despite some criticisms, a substantial number of comments indicate an “excellent overall experience”, with brokers noting “great pricing” and their improved ability to win deals based on Westpac’s current offerings.