The methodology

Now in its 16th year of publication, the Third- Party Lending Report helps track lender performance over time to show industry trends and changes in the competitive landscape.

The survey for the 2025 Third-Party Lending Report was conducted online between 17 February and 30 April 2025.

The survey encouraged mortgage and finance brokers across Australia to participate in a self-assessed evaluation of lender performance from their experiences over the last 12 months.

Participants were invited to complete this survey by email through The Adviser, Broker Daily, and Broker Pulse’s broker panel. Lenders were also encouraged to invite their affiliated brokers to contribute to the survey.

The survey received a total of 1,213 responses. After an extensive data validation process (including the removal of invalid, duplicate, or incomplete responses), the usable sample size was 1,024 brokers.

The full 2025 Third-Party Lending Report can be acquired from Broker Pulse by Agile Market Intelligence here:

As the third-party channel speeds toward a record share of Australia’s mortgage market, the major banks find themselves at a critical junction – forced to shift gears to keep pace with broker expectations.

But what do brokers want from their lender partners? And how do the majors compare? To find out, Broker Pulse – the lending insights division of Agile Market Intelligence – surveyed the broker channel for its annual Third-Party Lending Report.

Now in its 16th year, the annual survey asks mortgage and finance brokers to rate the performance of the lenders they have worked with over the last 12 months.

While brokers last year ranked credit assessment staff as the most important factor when recommending a lender to a client, this year, it was product pricing that came out on top (with 96 per cent of brokers rating this attribute as either “Extremely Important” or “Very Important”).

This was followed by product policy (95 per cent), credit assessment staff (94 per cent), turnaround times (93 per cent), and business development managers (92 per cent).

Also highly ranked were commitment to the broker channel (89 per cent), settlement performance (86 per cent), and upfront valuations (84 per cent), reflecting brokers’ need for dependable execution and broker-aligned processes.

The data reinforced the growing demand for lenders that can deliver sharp products with clarity, speed, and a strong service commitment.

As Michael Johnson, director at Agile Market Intelligence, says: “Brokers are placing greater importance on lenders who offer consistency, clarity and support throughout the process.”

He says that the lenders excelling are those delivering a “well-rounded proposition that balances strong products with dependable service”.

Who’s zooming ahead?

The Third-Party Lending Report confirmed that brokers – on average – continue to rely on three of the four major banks and an average of two non-banks when recommending lenders to their clients, according to the report.

While the big four banks dominate mortgage lending in Australia, the third-party channel – which accounts for a record 76.8 per cent of all mortgages in Australia – believes there is some room for improvement from these behemoths.

For example, despite the big four banks dominating the Australian mortgage market – and writing huge volumes through the broker channel – the Third-Party Lending Report shows that the top lender brokers use is not one of them.

According to the 2025 Third-Party Lending Report, Macquarie Bank overtook the majors as most commonly used lender in the third-party channel for the first time.

Two-thirds (66 per cent) of brokers used Macquarie Bank in the 12 months to April, surpassing ANZ (64 per cent), CBA and Westpac (both 58 per cent), and NAB (56 per cent). In fact, Macquarie Bank was also rated as the top lender overall among 38 institutions, excelling in service quality, turnaround performance, and overall broker satisfaction.

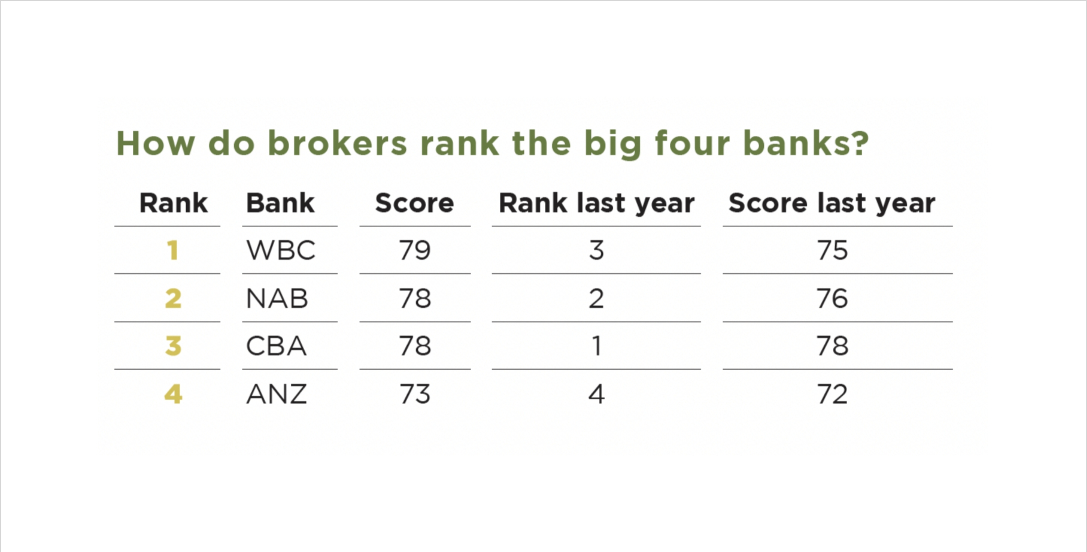

How do brokers rank the big four banks?

While major banks have consistently increased their broker satisfaction since 2021 and are leading in technology, they still have some way to go in improving overall broker scores.

The highest-ranked major bank (Westpac) came in ninth place of all 38 lenders this year, followed by NAB and CBA (10th and 11th).

ANZ continues to suffer with its score of 73 per cent, putting it down at 26th place.

For the first time in almost 10 years, Westpac was the highest-performing of the four major banks. The big four bank improved its score in nearly every attribute this year and greatly improved its ratings for speed in 2025 (at 82 per cent versus 73 per cent in 2024). The last time Westpac scored more highly was in 2016, when it achieved a score of 83 per cent.

Crossroads of growth

The changes come as brokers look more closely at the offerings of the major banks and amid a diverging pattern in broker flows at the big four banks.

As Westpac overtakes the other majors this year in the Third-Party Lending Report, it’s also speeding ahead in its volume of broker business.

In fact, Westpac’s broker flows rose to 67.5 per cent in the six months ending March 2025, while business from its proprietary channel dropped to a new record low.

Westpac CEO Anthony Miller acknowledged brokers as “important partners” and highlighted efforts to halve decision times since 2023 and remove pain points. The bank is also embracing AI to improve processes, communication, and speed up approvals for customers.

Damien MacRae, Westpac’s managing director for mortgages, affirmed its commitment to being the “bank of choice for brokers and customers”, with ongoing investments in service, competitive products, and digital innovations.

ANZ’s broker flows remained unchanged at 67 per cent in 1H25, following a record high in the previous financial year. The bank is piloting a broker offering for its new digital ANZ Plus Home Loan and has enhanced broker tools.

In contrast, NAB saw its broker flows drop to 59.6 per cent in its first half, down from 64.6 per cent a year prior. NAB CEO Andrew Irvine has openly declared a greater focus on proprietary lending to boost shareholder returns, a move that has drawn criticism from some brokers.

The bank reported a 25 per cent year-on-year increase in new proprietary mortgages and is onboarding new home lenders to support this strategy.

Despite this, Adam Brown, NAB’s executive broker distribution, says that NAB is investing in both channels, aiming to be “great in both”.

Similarly, CBA continues to see a downward trend in broker originations, accounting for just 32 per cent of new CBA-branded home loan flows (excluding Bankwest and Residential Mortgage Group). This contrasts with its proprietary channels, which made up a significant 68 per cent of new business in the three months to March 2025.

However, CBA’s new general manager of third-party banking, Baber Zaka, has expressed a clear strategy to grow the bank’s market share in the broker space, aiming to increase volumes across all segments and reduce channel conflict (see page 26 for more).

Given that brokers now account for a record three-quarters of Australia’s home loan market share (see page 6 for more), their collective sentiment and referral patterns could have a considerable impact on how the major banks’ mortgage flows move in the future, likely leading to even greater divergence in their strategic approaches this year.

As banks grapple with balancing technology and the promise of AI with channel conflict, the coming year will likely see further shifts in broker flows, with broker preferences playing a pivotal role. For the majors, the road ahead seems to be anything but straight.

The 16 attributes brokers were asked to rate banks on:

Personnel:

- BDMs: Overall quality of BDMs, including access to BDMs, BDM proactivity, and effectiveness in solving queries or challenges.

- Call centre support: Overall service quality, including staff technical knowledge, responsiveness, and helpfulness.

- Credit assessment staff: Access to and ease in dealing/communicating with credit assessment staff, including their consistency of credit decisions.

Products:

- Product policy: Comprehensiveness and clarity of product policies across key market segments.

- Product pricing: Competitiveness of pricing, interest rates, and fees of products across key market segments.

- Product range: Overall availability and depth of products available to suit key market segments.

Speed:

- Turnaround times: Overall end-to-end turnaround speed, including application processing, loan approval, contract, and funding timeliness. Support:

- Broker communication and training: Effectiveness of communication with brokers (verbal, written, or otherwise) when dealing with queries, processes, product price/policy changes, or servicing times.

- Commitment to the broker channel: Lender’s ongoing commitment and loyalty to the channel, enhancing services and support to brokers and their businesses. This includes avoiding activities or promotions that would be classed as channel conflict.

- Settlement: Settlement timeliness and ease of understanding, signature, and submission of documents.

- Post-settlement client support: Effectiveness in servicing clients post-settlement.

Technology:

- Application lodgement: Overall online application platform experience, including the user interface, speed, reliability, features, and functionality of the system.

- Broker website/portal: Effectiveness of broker website/portal, the functionality of the broker website/portal, and availability of information.

- Digital tools and online resources: Access to digital tools, including e-signature, verification of identity, and availability of online resources.

- Document submission (NEW): The volume of documents required for submission and the ease and experience of submitting these documents to lenders.

- Upfront valuations: Availability, functionality, accuracy, and effectiveness of the valuation ordering system and whether it provides greater consistency and rigour in the valuation ordering process.

Find out the key attractions and areas of improvement of Westpac, NAB, CBA and ANZ in the following pages