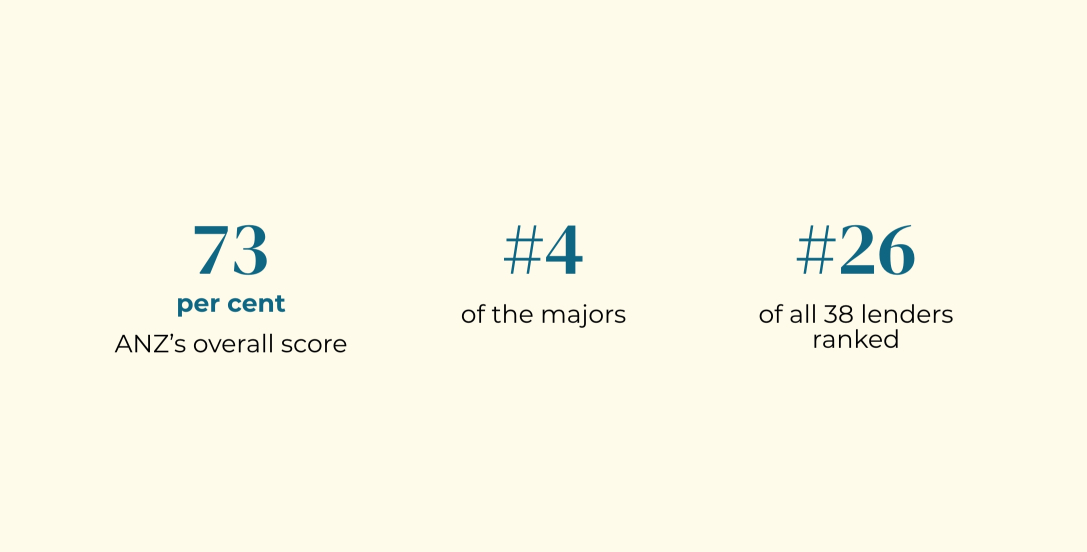

The lowest-scoring attribute for ANZ was its call centre support (64 per cent), with many brokers saying that the offshore nature of the call centre support resulted in antisocial calls, breakdowns in communications, and delays. (Similar problems plagued Westpac during the peak pandemic years, but were vastly improved once the lender onshored 1,000 jobs – including mortgage processing – in 2021).

ANZ was most highly rated for its products and technology