Australia’s mortgage market is shifting. While the big four still command the lion’s share of loans (see the July 2025 edition for more), the non-major banks are steadily winning over brokers and, by extension, borrowers. The latest Third-Party Lending Report reveals that not only are the non-majors growing faster than their larger rivals, but brokers also rank them as the highest-performing lenders in the country.

From speed of service to technology and broker support, the challengers are setting new benchmarks – and brokers are taking notice. Broker Pulse, the lending insights division of Agile Market Intelligence, surveyed 1,000 mortgage and finance brokers for its annual Third-Party Lending Report between 17 February and 30 April 2025 to understand what brokers think of the lenders they are using.

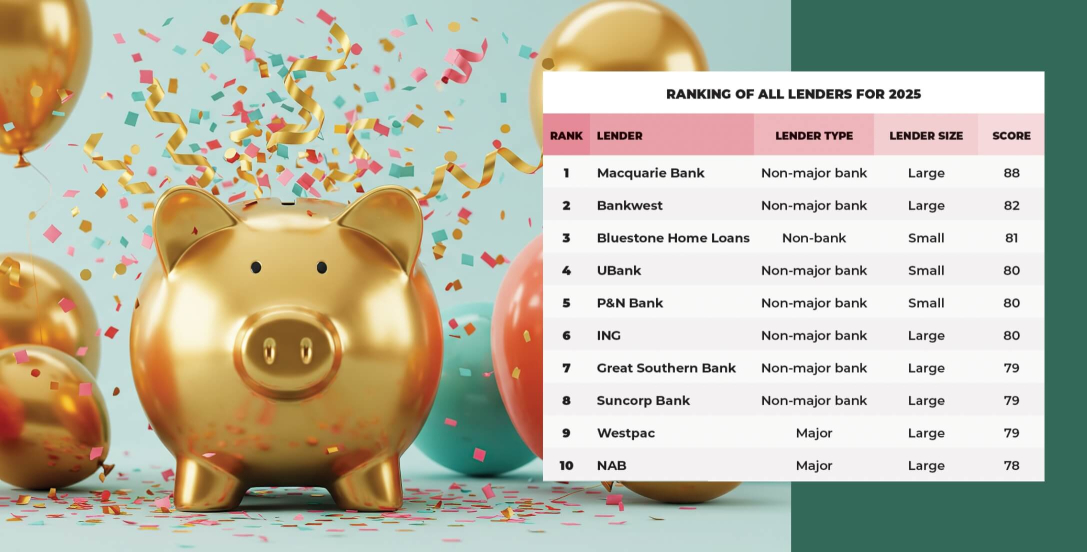

Looking at all 38 institutions in the final report, seven of the top 10 best-performing lenders were non-major banks. When only looking at the most commonly used lenders (those used by 20 per cent or more of respondents), the top five were all non-major banks. Given brokers write more than three-quarters of residential mortgages in Australia, what the broker market thinks of the lenders has real consequences to the size of the mortgage books. Indeed, while the big four banks continue to dominate in total volume, non-major banks are seeing the fastest rates of growth.

Macquarie Bank

Macquarie Bank – which has long been the darling of the broker channel – continues to dominate the segment. In fact, the size and scale of the bank’s mortgage book (and size of its deposit base) have many suggesting that this bank is competing on its own playing field now. Macquarie Bank remains one of the fastest-growing mortgage lenders in the country. It increased its total book to $144.53 billion in June 2025 – up 2.31 per cent month on month – one of the highest growth rates across all banks and lenders.

Macquarie Bank actually now sees itself as a major bank – but given its lack of a branch network/physical bank presence, we’re continuing to call it a non-major bank. According to the 2025 Third-Party Lending Report, Macquarie Bank overtook the majors as the most commonly used lender in the third-party channel for the first time, with two-thirds (66 per cent) of brokers using Macquarie Bank in the 12 months to April (ahead of major bank ANZ).

In fact, Macquarie Bank was also rated as the top lender overall among 38 institutions, excelling in service quality, turnaround performance, and overall broker satisfaction. It received a resounding seal of approval from brokers, with a score of 88 per cent in the 2025 report – its highest broker rating since the Third-Party Lending Report began. Speed of service has been the main attraction for brokers, with the channel giving Macquarie Bank a 96 per cent performance rating for speed in the Third-Party Lending Report, the highest score of any lender for turnarounds (and again, a record high for the bank). However, it also scored very highly for personnel (particularly its business development managers [BDMs], who were given a 91 per cent approval rating by brokers), followed by products, support, and technology – all with a rating of 87 per cent – far above the industry average of around 77 per cent. The bank’s commitment to the broker channel was also a call-out for Macquarie Bank, with a 90 per cent broker rating.

Bankwest

The second-highest-rated lender by brokers this year was Bankwest, with a rating of 82 per cent. The non-major bank, owned by the Commonwealth Bank of Australia (CBA), has had a transformational year as it has reimagined itself as a digital, broker-led bank. The orange bank, which now has a mortgage book of around $111 billion (as at June 2025, according to CBA’s full-year financial results), reimagined its app and website to deliver simpler digital banking, streamlined products, and end-to-end digital onboarding with 24/7 in-app support. The shift has been broker-led and lower cost, attracting more than 90,000 new-to-bank customers in FY25 (across both lending and transaction accounts) and reduced operating costs per customer by more than 20 per cent.

As such, it’s perhaps unsurprising that the bank was most highly rated by brokers for its technology (84 per cent), above the industry average of 77 per cent in the Third-Party Lending Report. Bankwest’s upfront valuations and broker portal were the most highly rated in the technology department. Personnel were also valued highly by brokers, with Bankwest receiving a broker rating of 83 per cent for its people this year. Of its staff, brokers said BDMs were particularly good – scoring a satisfaction rating of 87 per cent (above credit assessment staff and call centre support staff).

ING

When looking at the most commonly used non-major banks, ING Bank Australia (ING) was in third position, with a score of 80 per cent. According to APRA figures for June 2025, ING had a residential loan book of around $66 billion, making it now the sixth-largest mortgage lender in Australia for the first time in four years, following a stagnation in growth in Bendigo and Adelaide Bank’s loan book. The only other banks that have a larger loan book are the big four plus Macquarie Bank. ING suggested its growth was due to its “unwavering support of broker partners” and recent enhancements to its home loan offering. According to brokers responding to the Third-Party Lending Report, products were a leading attractor for ING – securing a broker rating of 81 per cent – particularly when it comes to pricing (which received a score of 84 per cent).

However, of all 16 attributes ranked, it was the bank’s commitment to the broker channel that received the highest score (86 per cent). George Thompson, head of mortgages at ING, commented: “Seeing ING back in the top six lenders is a strong signal that what we’re doing is working – from supporting the needs of more Australian borrowers to improving our digital experience for brokers and customers alike. “A big thank you to our broker partners for your continued trust and support. Let’s keep the momentum going.”

UBank

Another non-major bank that was very well rated this year included UBank, a subsidiary of National Australia Bank (NAB). While the size of the bank’s loan book has not yet been released for the full financial year (which ends in September 2025), its lending book was $15.1 billion at the end of March 2025, up 11 per cent over the year. The lender was the highest-rated of the less commonly used lenders this year (used by less than 20 per cent of broker respondents over the year), with an overall score of 80 per cent.

Over the past year, UBank has overhauled its broker lodgement platform to eliminate friction, reduce duplication, and give brokers more flexibility, making applications faster and easier to complete. By incorporating broker feedback and simplifying the process for both brokers and customers, the digital lender has strengthened its position with a system that saves time, reduces confusion, and delivers smoother loan submissions. It’s perhaps for this reason that brokers responding to the Third-Party Lending Report gave the bank its highest score for speed (87 per cent). However, UBank was also well rated for its BDMs and product pricing, which both received a score of 85 per cent.

Suncorp Bank

Suncorp Bank was the fifth best non-major bank of the most commonly used lenders this year, receiving a score of 79 per cent. It’s been a disruptive year for Suncorp, which was acquired by big four bank ANZ in July 2024. ANZ has suggested that Suncorp Bank’s home lending momentum has continued to improve since the acquisition, with second-quarter applications over 40 per cent higher than the previous six-month period and growth of over 1.6 times system for March 2025. However, according to APRA stats, Suncorp Bank had a mortgage book of $56.5 billion in June 2025, flat on June 2024 figures (but down on the bank’s self-reported March 2025 figures of $59 billion). Brokers responding to the Third-Party Lending Report gave Suncorp Bank its best-ever score – 79 per cent. They suggested that the bank’s speed was its best attribute – with a score of 83 per cent (its highest score for turnarounds ever).

Suncorp Bank also outperformed the industry average for all other categories, with BDMs and upfront valuations its other leading drawcards (both receiving a score of 83 per cent). The bank recently hired a new head of home lending product, Daniel Nicotra, to see how the bank can “level things up even further”, with brokers believed to be a core part of its future proposition. Other lenders that scored particularly highly included mutual lenders Great Southern Bank and P&N Bank (see the August 2025 edition of The Adviser for a breakdown of their performance, as rated by brokers).