As Australia’s mortgage market becomes increasingly diverse and complex, brokers are turning to non-bank lenders to access flexible and tailored solutions for their clients. Once considered niche players, non-bank lenders are now a mainstream component of the lending ecosystem, particularly for clients who fall outside traditional lending criteria or need a more bespoke approach.

Amid a tightening credit environment, rising property prices, and evolving borrower needs, non-bank lenders are standing out for their adaptability, speed, and service. Many are innovating quickly and leaning into tech-driven efficiencies while maintaining a strong human touch, particularly through BDM support and responsive credit teams.

But how do these lenders stack up? The latest Third-Party Lending Report 2025, produced by Broker Pulse (the lending insights division of Agile Market Intelligence), provides further illumination.

How do non-bank lenders stack up?

Now in its 16th edition, the Third-Party Lending Report surveyed 1,000 mortgage and finance brokers across Australia between 17 February and 30 April 2025, drawing on their experiences with a range of bank and non-bank lenders.

The 2025 findings are clear: broker sentiment towards non-bank lenders remains strong and is improving.

In fact, broker usage of non-bank lenders for residential loans reached its highest point since Broker Pulse began tracking this metric. In 2021, 74 per cent of brokers reported using non-banks for residential lending. By 2025, that figure had climbed to 84 per cent. Notably, this figure excludes SME, boutique, and private lenders, suggesting even wider use across the non-bank sector when these are included.

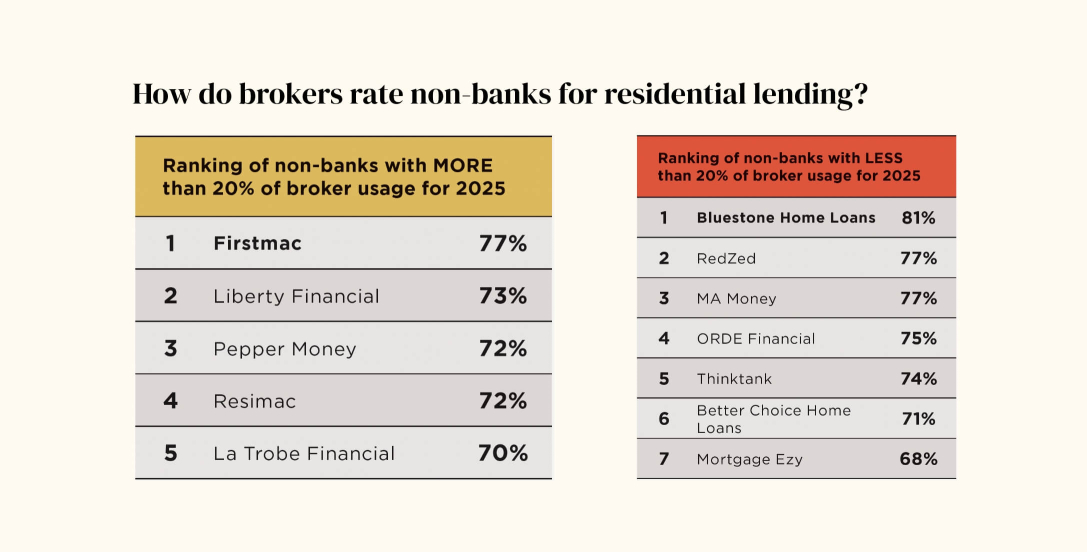

What’s more, the results indicate that even the lowest-ranked non-bank lenders still received generally positive broker ratings, with the non-bank sector performing on par with traditional banks.

The top-performing non-banks

Firstmac

Firstmac once again led the pack in 2025, taking out the title of top non-bank lender for the seventh consecutive year. Its broker satisfaction rating increased from 74 per cent in 2024 to 77 per cent in 2025. Brokers applauded Firstmac for its:

- Strong and responsive BDM support.

- Excellent SMSF lending products.

- User-friendly online portal.

- Strong servicing capacity.

However, brokers also noted several areas for improvement, including the lack of upfront valuations, occasional issues with communication from the credit team, inconsistent system information, and concerns around channel conflict, where brokers reported borrowers could sometimes access better rates through Firstmac’s direct platform.

Liberty Financial

Liberty Financial followed closely with a 73 per cent rating. Brokers praised Liberty’s:

- Streamlined processes for low-doc and business borrowers

- Responsiveness and service quality.

- Ability to communicate directly with assessors.

Despite these strengths, Liberty was critiqued for high pricing, slow discharge times, and a perception that its product suite could be more competitive, particularly for borrowers who don’t fall into near-prime or specialist categories.

Pepper Money

Pepper Money rounded out the top three of the most commonly used non-bank lenders. Known for its near-prime offerings, Pepper was praised for:

- Flexible lending for casual workers and debt consolidation.

- Comprehensive product range.

- Streamlined assessment process.

However, some brokers reported dissatisfaction with Pepper’s pricing for prime customers, high application fees, and variability in BDM responsiveness.

Bluestone Home Loans

Among the smaller, lesser-used non-bank lenders, Bluestone Home Loans again led the field, securing the top rating in this category for the sixth year in a row. Its broker satisfaction score rose from 75 per cent in 2024 to 81.5 per cent in 2025.

Bluestone was commended for:

- Deep understanding of self-employed borrower scenarios.

- Transparent and flexible credit assessment.

- Strong BDM support.

However, some brokers noted challenges with slow assessment times, inconsistency in policy application, high pricing, and difficulty communicating directly with credit assessors.

Neck and neck

RedZed and MA Money were almost neck and neck for the next positions, with just decimal points between them. Both lenders received positive feedback from brokers, with scores of just over 77 per cent.

RedZed

RedZed was highlighted as a quality specialist lender, particularly for SMSF and Alt Doc scenarios, with standout service and BDM support. Brokers did not raise significant negative feedback for RedZed in the 2025 report.

MA Money

Meanwhile, MA Money received broker praise for:

- Excellent and supportive staff.

- Speedy approvals and settlements.

- Digital innovation and tech adoption.

However, a recurring frustration stemmed from the lender’s legal partners, with some brokers citing document errors and settlement delays as ongoing pain points.

Best of the rest

Several other non-bank lenders also made a strong impression on brokers:

- La Trobe Financial was applauded for its responsiveness and knowledgeable BDMs.

- Resimac stood out as one of the few non-bank lenders offering competitive rates.

- Advantedge, which is in the process of being folded into NAB, received high marks for consistency and efficient processing – an impressive result given its impending closure.

As the lending landscape becomes more nuanced, brokers are increasingly seeking out lenders that can tailor solutions for clients with complex needs, fast turnarounds, or alternative documentation.

Non-bank lenders continue to rise to this challenge, offering a level of agility and specialisation that resonate with brokers and borrowers alike.

With more aggregators incorporating non-banks into their lender panel – and client expectations evolving – lenders that can combine flexible policy with clear communication and consistent service are best placed to win broker loyalty.

The results of the Third-Party Lending Report 2025 suggest that the future remains bright for non-bank lenders that continue to invest in their relationships with brokers, prioritise service and speed, and refine their offering to fill the gaps left by the mainstream banks.

When it comes to finding the right fit for increasingly diverse borrowers, non-bank lenders are helping brokers ensure their clients are dressed to impress.