Australia’s customer-owned banks have long been a popular banking sector, set up to service a particular cohort of customers and build trust in the community.

The legacy of what the mutual banks stand for, and how they operate, continues to see this lending arena gain the trust of Australian consumers. According to Roy Morgan’s Bank Trust and Distrust Scores Report (based on a survey of approximately 25,000 Australians), for example, customer-owned banks were named Australia’s most trusted banking sector for the second year in a row in 2025.

This trust stems from the mutual banking sector’s generally more people-focused approach – championing its members and communities and typically taking a strong focus on ethical lending and investments. Brokers often appreciate this people-first approach, ethical lending, and strong community focus.

But while the reputation of mutual banks is tracking along strongly, the sector has been changing rapidly behind the scenes, with a diminishing number of institutions in market as more consolidate to remain competitive and manage soaring operational costs.

To understand how the changing dynamics of the lending market are influencing the broker channel, Broker Pulse, the lending insights division of Agile Market Intelligence, surveyed 1,000 mortgage and finance brokers for its annual Third-Party Lending Report.

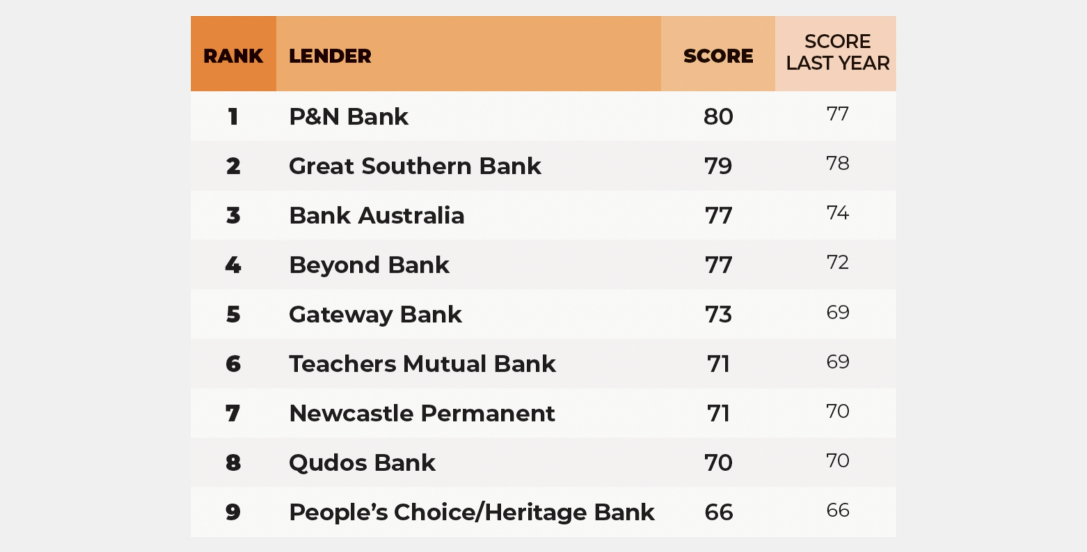

The 16th edition, based on a survey conducted online between 17 February and 30 April 2025, included nine mutual banks in its final analysis.

Interestingly, the survey results reveal a compelling trend: smaller, independent mutual banks are faring particularly well in broker sentiment, often outperforming their larger, recently merged counterparts.

First class

Great Southern Bank (GSB) emerged as the most commonly used mutual lender, with 21 per cent of surveyed brokers having submitted at least one application to them in the past year. This was closely followed by both People First (formerly People’s Choice/Heritage Bank) and Newcastle Permanent at 16 per cent each, then Teachers Mutual Bank (11 per cent) and P&N Bank (10 per cent).

Fewer than one in 10 brokers reported using Bank Australia (9 per cent), Qudos Bank (8 per cent), Beyond Bank (8 per cent), and Gateway Bank (4 per cent).

However, it was P&N Bank that secured the top spot for customer-owned banking segments this year. P&N Bank received an impressive 80 per cent rating from 99 brokers across the 16 attributes measured, which encompassed products, personnel, speed, support, and technology.

This marks P&N Bank’s first time receiving this accolade, with strong performance in BDMs, call centre support, and credit assessment staff.

Oliver Stofka, commercial director at Agile Market Intelligence, commented: “P&N Bank has had a remarkable turnaround over the last few years to become a genuine market leader in the broker market. Their personnel, most notably their BDMs have been leading the way for the bank, leaving a great impression on brokers over the last 12 months.”

P&N Bank has had a remarkable turnaround over the last few years to become a genuine market leader in the broker market

– Oliver Stofka, commercial director, Agile Market Intelligence

P&N Bank’s strong service is evident in its rankings, securing first place in five attributes – call centre support, BDMs, credit assessment staff, broker communication and training, and post-settlement client support – and performing highly in the remaining 11. This performance placed P&N Bank as the fifth-highest-rated lender among all 38 institutions surveyed, behind only UBank (80 per cent), Bluestone Home Loans (81 per cent), Bankwest (82 per cent), and Macquarie Bank (88 per cent).

Great Southern Bank was the second-highest-rated mutual bank and the only other mutual lender to break into the top 10 (ranking seventh overall) with a rating of 79 per cent.

It was particularly well-regarded for its personnel, products, and support and also received above-average ratings for its technology offering.

Notably, however, it’s the smaller mutual banks that seem to be winning the hearts and minds of brokers.

P&N Bank, for example, is one of the few mutuals that has not merged with another lender recently. In fact, its proposed merger with Beyond Bank was called off last year after questions were raised at the due diligence stage.

In contrast, People First Bank – the largest of all the mutuals when it comes to loan book size – was the lowest-rated mutual bank this year.

It scored below average for all five core categories (personnel, products, speed, support, and technology).

Brokers particularly lampooned the lender for speed, with its rating dramatically falling to 46 per cent in 2025 (down from 58 per cent in 2024 and well below the industry average of 79 per cent).

This suggests that while scale through mergers might increase loan book size, it doesn’t automatically translate to improved broker satisfaction, particularly in critical areas like efficiency.

The coupling express

The number of mutual banks in Australia has been plummeting over the past few years, as more consolidate and merge to keep up with the cost and competitive nature of banking in the 21st century. There are now around 50 customer-owned banking institutions, a significant reduction from previous years.

The largest by residential loan book is People First Bank, formed from the 2023 merger of Heritage and People’s Choice Credit Union, boasting a residential loan book of just under $20 billion ($19.8 billion as of May 2025).

Close behind are Newcastle Greater Mutual Group Ltd (formed by the 2023 merger of Newcastle Permanent and Greater Bank, both brands are still operating), Great Southern Bank, and the newly merged Bank Australia and Qudos Bank (effective July 2025). These latter institutions all hold around $18 billion in home loans, according to APRA.

Teachers Mutual Bank Limited, with approximately $10 billion in residential home loans, is also rapidly expanding through its proposed merger with Australian Mutual Bank, aiming for completion in 2026.

This would expand their customer base to over 300,000 and combine assets to $13.4 billion.

Like many recent mergers, this aims to boost investment in member services, product offerings, and fraud prevention technology while maintaining existing brands and branch networks. This is particularly important for the smaller mutual banks, which have fewer resources.

Take the recently completed merger of Unity Bank and G&C Mutual Bank – as well as that of Community First Bank and Illawarra Credit Union – as examples. Both sought to strengthen community reach, grow their deposit and capital base, and achieve cost and scale synergies.

The prudential regulator has already explicitly stated that mergers can provide access to advanced technologies and expertise that would otherwise be prohibitively expensive for smaller institutions.

But it also recently highlighted a skills gap on some mutual boards, particularly in technology, urging upskilling and the injection of “fresh talent” to navigate the modern banking environment. As such, merging with other lenders in the space could help the customer-owned banking space attract a broader range of talent and help them thrive into the future.

But the rapid pace of consolidation could be slowing down. Proposed changes to merger fees (part of the federal government’s plan to introduce a mandatory and suspensory merger control system) from 1 January 2026 could see charges for assessing mergers become untenable. It has been proposed, for example, that phase 2 assessment charges (a recent example of which being the ANZ-Suncorp Bank merger) would reach nearly $1 million.

The ACCC said that phase 2 reviews account for almost two-fifths (39 per cent) of the total costs involved in ACCC merger decisions, despite involving a small number of reviews (it forecast that 8.5 applications will reach this stage in the financial year 2026).

According to the regulator, the reason for hiking the fees is because these are typically high-risk or complex mergers that pose the highest risk of competitive harms to the Australian economy and require “extensive legal and economic analysis, utilising compulsory notices, data analysis, oral examinations, and potentially external expert advice” to conclude the likely effects of the merger.

While these fees aim to shift the cost burden from taxpayers to merging businesses and ensure the ACCC is properly resourced, concerns have been raised about their disproportionate impact on smaller transactions.

As such, if a mutual bank hasn’t yet merged, it may be prohibitive to do so in future. But given what the Third- Party Lending Report survey results show, size doesn’t always matter.