The beauty of the broker channel is its ability to offer choice and convenience to borrowers, offering a wide range of lenders and a wide range of credit appetites to borrowers

Consumer research, such as Deloitte’s Value of Mortgage and Finance Broking 2025 Report (commissioned by the MFAA) and Agile Market Intelligence’s Consumer Access to Mortgages Report (commissioned by the FBAA), showed that the convenience that the third-party channel provides in traversing the lending landscape (and coming up with recommendations that are in the best interests of the borrower) are key factors to the growing popularity of the broker channel.

Fundamentally, a broker is only able to provide choice to borrowers thanks to their access to lenders. For the majority of brokers, the array of lenders at their disposal comes down to the size and breadth of their aggregator’s lender panel. And it’s taken as read that any aggregator will have a broad range of lenders on offer, from the big four banks through to smaller, regional lenders and private lenders.

But a new trend of aggregators dropping lenders has some worried that panels may be shrinking and for new reasons.

What do brokers think?

According to the Value of Mortgage and Finance Broking 2025 Report, the average aggregator has 45 lenders on its panel, including 18 non-major banks and 23 non-bank lenders.

Surveyed mortgage brokers reported that, on average, they are accredited with 23 different lenders through their aggregator. But some brokers can access up to 80 lenders through their aggregator panels (both Australian Finance Group [AFG] and Loan Market Group have over 80 lenders on their panels).

While the size of an aggregator’s lender panel has historically been a low priority for brokers when it comes to choosing a group to partner with, it’s growing in importance.

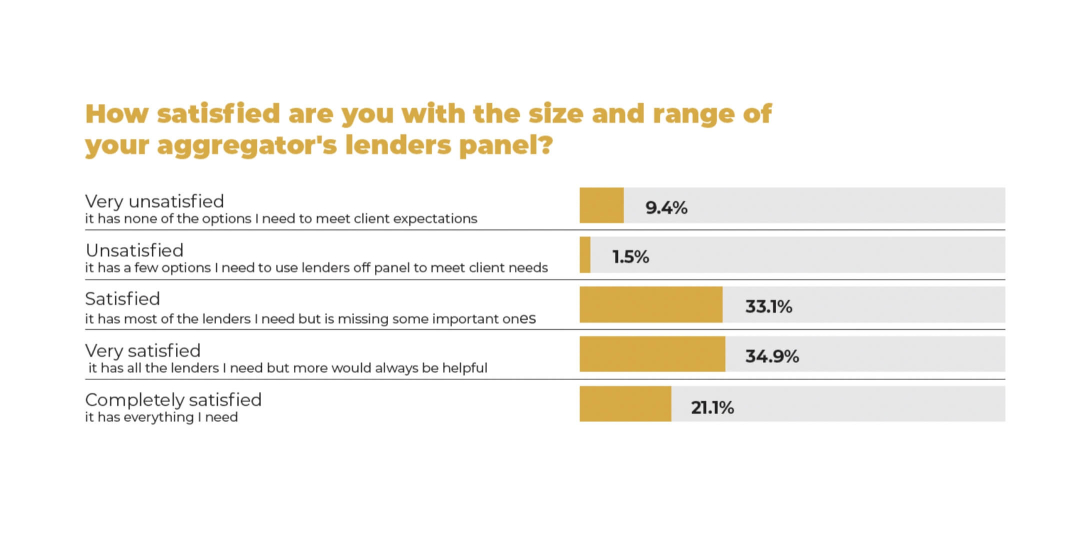

According to the April edition of the Broker Pulse survey, the majority (89 per cent) of brokers are satisfied with the size and range of their aggregator’s lender panel. However, even a third of these believe their panel is “missing some important [lenders]”.

Speaking to The Adviser, Matt Turner of GSC Finance Solutions says: “With more and more competition coming to the broker market, it has never been more important to have a diverse lender panel. Clients are constantly being bombarded with choice, so – as a broker – I am looking for the edge that might be the difference between winning a new client or losing them to a competitor that has that choice.