A word from Real Flow

Empowering brokers with smart funding solutions

At Real Flow, we’re committed to supporting Australia’s leading brokers with smarter, simpler funding solutions that help your customers move confidently through every stage of their property journey.

Our innovative solutions include Equity Flow, providing fast, flexible equity release that bridges the gap between sale and settlement – keeping deals moving without disrupting finance approvals. For landlords, Rent Flow offers advanced access to rental income, supporting cash flow and portfolio growth.

With rapid approvals, transparent terms, and trusted relationships across Australia’s leading real estate networks, Real Flow is redefining how finance flows between property, broker, and customer.

See how Real Flow is helping brokers deliver faster, smoother outcomes for your customers.

The financial year ending June 2025 was another bumper year for mortgage brokers, particularly in the second half of the year as borrowers took advantage of a falling rate environment.

According to property settlement platform PEXA, 544,630 new property-backed loans were settled in FY25, 6.8 per cent higher than in FY24, with 96 per cent of these attached to a residential property.

Brokers have been a driving force in helping these home buyers access the finance they need to buy these properties, with figures from the Mortgage and Finance Association of Australia suggesting that brokers write a record 76.8 per cent of home loans in the March 2025 quarter (the most recent figures available at the time of publication).

But mortgage broking in 2025 looks very different from just a few years ago. Rising property prices, shifting borrower expectations, and the growing role of technology have reshaped how brokers do business.

The very best in the industry are those who have combined exceptional customer service and a killer process with deep product knowledge and digital agility to deliver faster, smarter outcomes for clients. Alongside this, they continue to lean on the fundamentals: strong client relationships, robust referral networks, and trusted credit advice that puts borrowers first. These brokers have not only kept pace with change – they’ve stayed a step ahead.

And the results speak for themselves. The Adviser’s Elite Broker Ranking 2025 shines a spotlight on the crème de la crème of the broking industry, celebrating excellence among top performers across Australia.

In the second annual edition, we reveal the elite residential brokers responsible for writing the largest volume of home loans in the country.

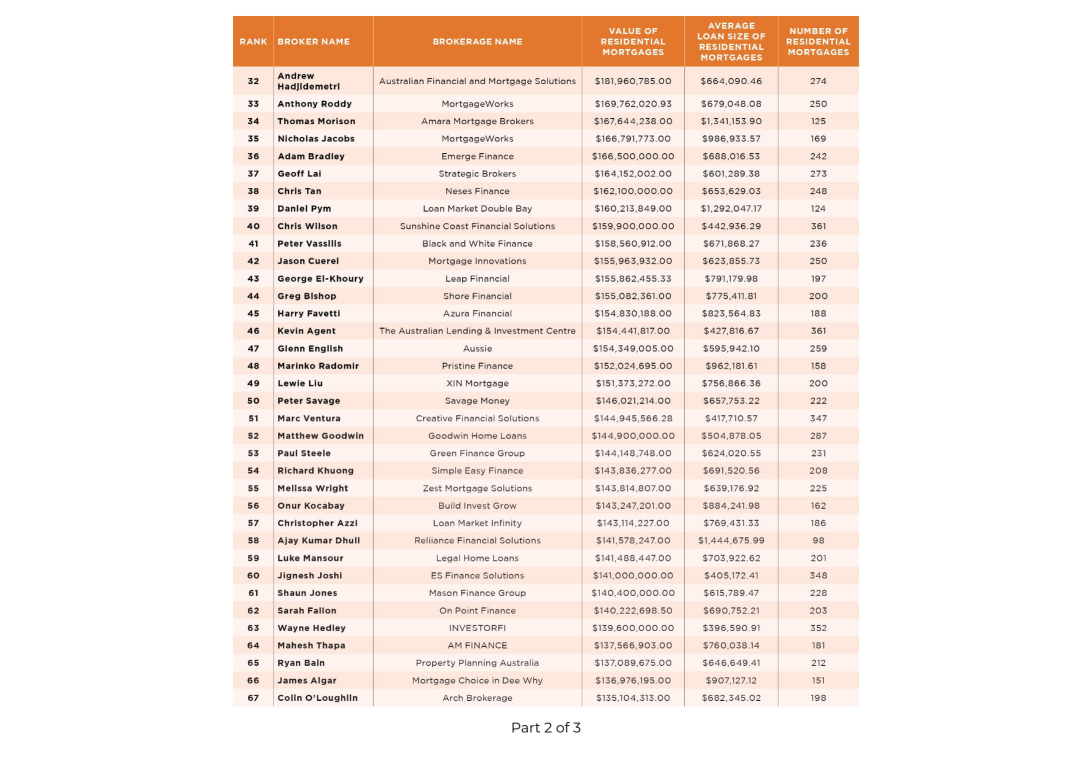

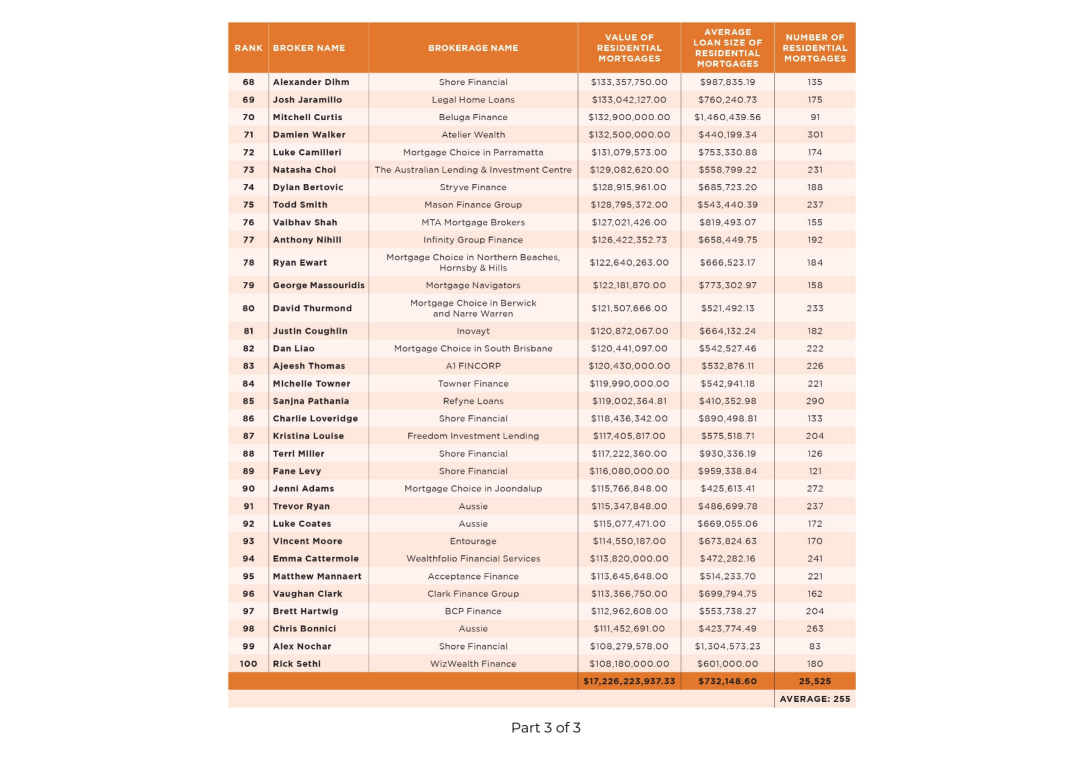

Collectively, the top 100 Elite Brokers – Residential wrote an astounding $17.2 billion in mortgages in FY25, nearly a third higher than in 2024. This reflects not only the growing value of mortgages being written in Australia, but also the growing number of loans brokers are able to write.

Based on residential volume alone, the top five brokers were (perhaps unsurprisingly) all based in NSW, where property prices are the highest in the country. But interestingly, it wasn’t a Sydney-based broker who topped the chart for 2025.

Topping the ranking this year was Hunter Valley-based broker Katie Thomas from Focus Finance, who wrote $496,454,238 in residential loans over FY25 across 280 loans. That makes her average loan size a huge $1.77 million. While not relevant to her final ranking spot, she also submitted a huge 421 applications totalling over $496,454,238 in FY25.

Her colleague Ashlee Sillay also made it into the ranking this year, coming in 31st position after having settled $182,789,016 across 214 loans in FY25. In fact, the three-person brokerage has achieved remarkable growth over FY25, having collectively submitted around 956 applications into the system over FY25.

In second place was Michael Xia from Mortgage Channel, who settled $490,172,1845 in residential home loans over the last financial year. Xia also wrote the largest number of home loans of any broker, at a whopping 1,001 loans in FY25.

According to his verified figures, he settled these loans for 436 clients – showing that many are coming to him for multiple transactions (e.g. investors) – with April being a bumper month for him, as he settled over 110 loans that month.

Outside of NSW, the broker who wrote the largest dollar value in residential mortgages over FY25 was Mark Davis from the Australian Lending & Investment Centre (ALIC). The Queensland-based broker (previously based in Victoria) settled $315,210,004 loans in FY25 across a massive 598 loans.

And special mention goes to Mortgage Choice Ormeau broker Deslie Taylor, who was the highest-ranked female residential broker in the Elite Broker Ranking for the second year in a row.

In fact, while house prices and mortgage volumes differ across the country, what is the same across all the elite brokers in the ranking is the huge number of home loans they’ve been able to settle.

There were a total of 255,525 mortgages settled by the top 100 brokers in the last financial year, with the brokers writing an average of 255 home loans over the year. The number of loans rose by 23 per cent over the year – perhaps reflecting the improvements in technology, the adoption of artificial intelligence (AI), and the growing amount of support staff brokers are now using in their day-to-day operations.

As such, these brokers exemplify that not only are they generating a large volume of business, but they’re also masters of efficiency and have mastered how to navigate the complexities of the mortgage market quickly.

Methodology of the ranking

To ensure the integrity and credibility of the Elite Broker Ranking, a robust methodology was employed. Undertaken by Agile Market Intelligence on behalf of The Adviser, brokers were invited to submit data regarding the number of home loans settled, the value of these loans, and the average size of loans written for the financial year ending June 2025.

Each broker was required to provide evidence supporting their submissions, which were meticulously verified. The final ranking was determined by ranking the brokers by largest settlement volumes in dollar terms.