2025 was a big year for everyone at Mortgage Choice, and there’s no sign of this momentum slowing. The property market continues to change rapidly, and consumers expect even more personalised, data-driven home loan solutions, coupled with advice from experts they trust.

In this landscape, aggregators play a vital role in providing their brokers with scalable tools and support that help them serve more customers without additional cost.

Engaging consumers throughout their journey

Finding the right property and the right finance can be an overwhelming experience for many Australians. That’s why we’re embedding our brokers at the very heart of the property search.

Through our connection to realestate.com.au, and its audience of more than 12.6 million Australians per month*, we are uniquely positioned to help consumers find and finance their property.

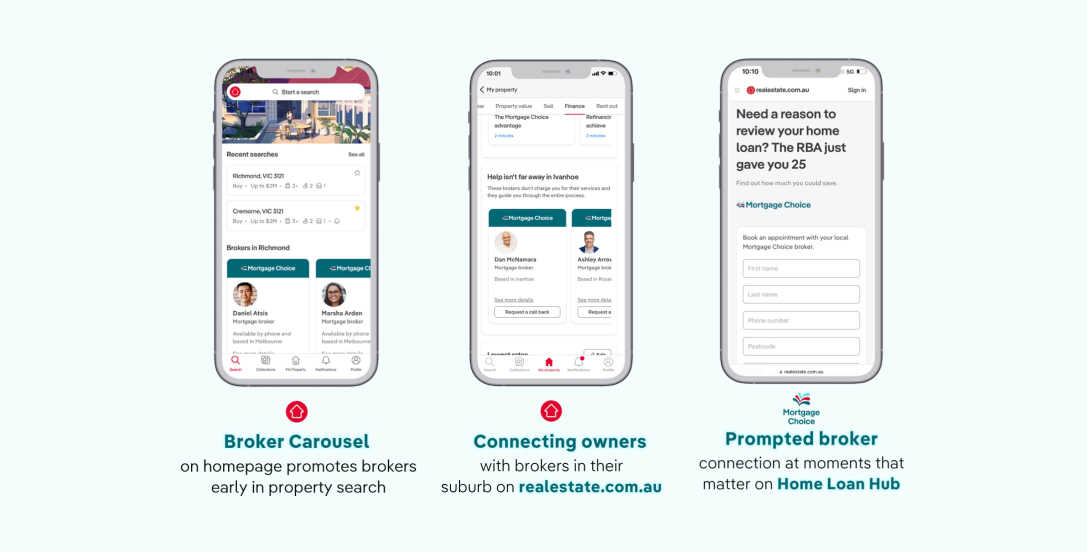

We are continuing to deeply integrate our brokers into realestate.com.au. This shows up in a variety of ways, including Dynamic Broker Carousels, which make it simpler to connect with a local broker; to integrated lead forms, which deliver personalised results and offer a broker’s help at the moment a consumer needs it; and the Home Loan Hub, which features intuitive tools, guides, and information.

Broker touchpoints are also embedded in the tools consumers use on realestate.com.au, such as affordability calculators, property owner dashboards, and inquiry forms to help consumers seamlessly connect with a broker when they’re looking into their borrowing capacity or submitting a property inquiry.

We empower our brokers with data to help them create deeper relationships with their customers. The reporting capabilities within our CRM provide our brokers with clearer and more actionable insights, including using sophisticated AI modelling to provide brokers with predictive insights into customers with a high likelihood to refinance.

Our brokers also have access to an intelligent social media scheduling tool, and our custom artwork platform houses hundreds of professionally designed customisable assets that brokers can use to promote their business locally.

Our life cycle marketing combines automated client care communications with regular news and updates and targeted campaigns. Enhanced personalisation helps brokers connect with their customers.

Investing in our brand

This year, we supercharged our investment in our brand.

We launched our new national marketing campaign, ‘More’, which put our brokers front and centre. The campaign showcases how brokers deliver more choice from our panel of lenders, more expertise, more care, and access to more insights, thanks to our connection to realestate.com.au. This multichannel campaign was a fantastic celebration of our diverse network right around Australia.

We helped our brokers leverage the investment in our national brand at a local level, delivering support and tools so they could run local campaigns and events to nurture connections in their communities.

Our investment in our brand didn’t stop there – we also announced our partnership with the NBL for the 2025–26 season, helping us reach a new audience across metro and regional areas.

Putting values at the heart of what we do

In August, we announced the results of a nine-month piece of work to define what Mortgage Choice will stand for as we move ahead in our next chapter. What emerged through hours of collaborative discussions and workshops with brokers is their belief in their clients’ potential. Even when they can’t see a path through, or the next step, our brokers see it for them. They empower potential.

Our purpose and values underpin how we define ourselves, how we work, our vision and purpose, and form part of everything we do.

Our brokers continue to demonstrate their commitment to the communities they serve, with our Mortgage Choice Charity Foundation donating more than $444,000 for Australians in need in the financial year 2025.

Empowering through technology

As technology, particularly AI, began to transform the broking industry in 2025, we launched the Mortgage Choice AI Academy, a comprehensive learning program and toolkit to uplift our brokers’ AI mastery.

In 2025, our brokers received secure access to Google’s Gemini AI, which is integrated into their Google Suite. To complement the launch, we released a range of custom Gemini Gems, designed to enhance broker productivity.

We also released new functionality in our proprietary Broker Platform, including our industry-first integration with Quickli, which minimises double-data entry and allows brokers to start scenarios in the platform. And our integration with NextGen’s open banking tool, the Frollo Financial Passport, gives brokers access to AI-powered, real-time insights into their customers’ financial position.

Enabling broker growth

We know that each broker has their own unique needs and goals, which is why we offer a suite of tailored development programs to support brokers throughout their careers. From our Broker Success Program that helps new brokers lay strong foundations in their first year; to our Peloton Program, designed to propel established franchisees into their next phase of growth; the Leaders’ Circle, for our top-performing businesses; and our Aspire Program for the women in our network.

In 2025, we also released the Mortgage Choice Learning Hub, a central platform for broker training that offers live and on-demand education, plus an evolving best practice library.

In a time of rapid change, the role of brokers as trusted experts has never been more important. As we look to 2026, I’m excited about what we can continue to build in partnership with our brokers to take Mortgage Choice to even greater heights.

*Source: Ipsos iris Online Audience Measurement Service, Jul 2025 - Sep 2025 (average), P14+, PC/laptop/smartphone/tablets, text only, Homes and Property Category, Brand Group, Realestate.com.au, Audience (000’s).