Brokers remain confident moving into the new year buoyed by robust property markets and the belief that investor activity will remain high

It would appear that the government’s two consecutive interest rate hikes over October and November, the end of the increased first home owners grant as well as the traditionally slow period over Christmas have dampened brokers’ sentiment towards business growth for the quarter ahead.

To continue reading the rest of this article, please log in.

Looking for more benefits? Become a Premium Member.

Create free account to get unlimited news articles and more!

Looking for more benefits? Become a Premium Member.

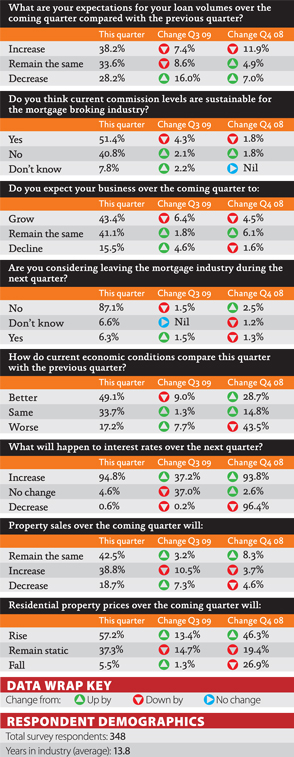

Mortgage Business’ Q4 sentiment survey, conducted in late November prior to the most recent December 25 basis points hike to the official cash rate, has shown an overall decline in broker sentiment towards loan volume growth, plans to hire staff, overall business growth and marketing spend.

These four components make up the Mortgage Business Index, which this quarter sits at 29.3 per cent compared to the 30.6 per cent registered last quarter and the 37.0 per cent in Q4 2008.

While these key business indicators highlight softening in sentiment, brokers remain bullish towards business opportunities but recognise the need to work harder – and smarter – to win them.

Over 59 per cent of respondents said they expect to source most business from existing clients over the coming quarter, up 7.8 per cent on Q3, with investors a key target.

A resounding 49.1 per cent of brokers anticipate the investor sector to be most active in the quarter ahead. Outside of the investor segment, 32.8 per cent of respondents said refinancers would be most active, followed by upsizers / downsizers at 13.8 per cent.

Just 4.3 per cent of respondents said the first home buyer segment would offer the most activity in the quarter ahead, down 7.6 per cent on Q3 – reflecting the end of the beefed-up first home owner grant.

Sentiment towards the government’s handling of the economy has also waned.

While 47.7 per cent of respondents believe the government is doing a good job of managing our economy, this is down 9.6 per cent on Q3. Over 42 per cent now believe the government is not doing a good job, up 7.7 per cent on Q3 and 1.8 per cent on Q4 2008.

Broker faith in the RBA’s management of inflation has also dropped, with 60.1 per cent feeling it is effective, down 15.2 per cent on Q3, however this drop could be the result of negative perception towards the RBA’s hikes to the cash rate and anticipated drop in broker business as a result.

Indeed, 51.7 per cent of respondents said that the current cash rate will negatively impact the demand for home loans over the coming quarter, which is up by 30.5 per cent on Q3.

Moreover, brokers are split on property market activity over the coming quarter.

A narrow majority of 42.5 per cent of respondents expect no change however 38.8 per cent of respondents still anticipate property sales activity to climb.

House price growth is also expected over the coming quarter with 57.2 per cent of respondents saying prices will climb, up by 13.4 per cent on Q3 and a whopping 46.3 per cent on Q4 2008.

All in all, 72.4 per cent of respondents said the property market would represent good value to buyers in the quarter ahead, down 3.2 per cent on Q3.

Login

Login